Staff Reporter

ATA Truck Tonnage Rises 1.2% Sequentially in October

[Stay on top of transportation news: Get TTNews in your inbox.]

The freight market showed renewed signs of recovery in October after stumbling in September, American Trucking Associations reported.

The ATA For-Hire Truck Tonnage Index for October increased 1.2% to 114.6 from 113.3 the previous month, ATA said Nov. 19. While the index slipped in September, it also posted sequential improvements during August and July. Year over year, tonnage was down 0.5% compared with October 2023.

“The slow, and choppy, climb off of the bottom continued in October,” ATA Chief Economist Bob Costello said. “Since hitting a low in January of this year, tonnage is up a total of 3%, plus the index is up sequentially in three of the last four months. No doubt the freight market has improved — albeit slowly — over the course of the year.”

The increase in freight demand has been particularly noticeable at the ports. In October, the Port of Los Angeles even reached four consecutive months of container volumes exceeding 900,000, the first time that has happened. The Port of Long Beach reported achieving its strongest month ever at about a million cargo containers handled.

Costello

“What you’re seeing at the ports is, the demand for product is elevated for two reasons,” said Rajeev Dhawan, director of the Economic Forecasting Center at Georgia State University. “The U.S. economy is not as weak as we expected about six or eight months ago. And No. 2, the biggest thing on the horizon is tariffs, when are they coming, how much are they.

“But they are coming. So once you have that issue, you would like to do your purchases as early as possible and that is what is showing up in the port data.”

Dhawan pointed out that the election being over removes some degree of uncertainty for businesses. But now they are moving cargo ahead of the expected tariffs the incoming Trump administration has made a policy objective.

Dhawan

“If you need to buy the stuff and you have the capacity to hold it, it doesn’t hurt you to buy it early if the product is not very cycle-specific like fashion,” Dhawan said. “But if you are buying washing machines, let’s say, and you have the capacity to buy it early and hold it, you would do it.”

Dhawan hasn’t seen a huge increase in freight leaving the ports despite the increase in imports. He suspects a lot of this freight isn’t moving inland by trucks or rail, and is instead going immediately into the warehouses and holding.

“Once it’s clear that the tariffs are coming, you would like to bring in your stuff and make your deals and have the shipments at the port before the tariffs are applicable,” Dhawan said. “Which means that between now and January, there will be [a lot of] activity to bring in the stuff. It won’t take a break.”

John Elliott of Load One demonstrates how onboard video combined with AI-enabled analytics can transform fleet safety. Tune in above or by going to RoadSigns.ttnews.com.

Dhawan added that not everyone can rely on storage. First, it depends on where the company is located as warehousing isn’t abundant everywhere. Second, it can be costly, so there may be an immediate financial barrier. But for those who can purchase warehousing, it may have become cheaper recently.

“Remember, in the third quarter of this year, the dollar had become much weaker than before,” Dhawan said, “still pretty strong compared to the prior six months. That always hurts your cost of buying abroad, because when the dollar is weaker, it’s more expensive to buy the imports. But the dollar has become really strong in October and November. So now the cost of holding, buying the stuff early and warehousing it, is cheaper compared to two months ago.”

The Logistics Managers’ Index registered a 58.9 for October compared with 58.6 in September, the 11th consecutive month of overall increases. The index authors cited this as evidence that the logistics industry is back on solid footing and also noted that transportation prices experienced their fastest rate of growth since May 2022.

“It is possible that as transportation prices continue to rise more idle capacity will come off the sidelines to take advantage of the increased opportunity, leading to the somewhat counterintuitive situation that we now find ourselves in where both transportation prices and capacity are increasing,” LMI said in its October report. “By contrast, our three warehousing metrics have remained fairly stable as capacity grows at a steady rate.”

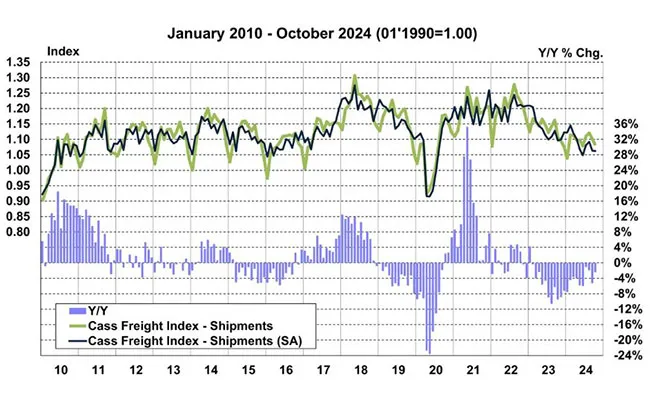

Cass Freight Index — Shipments

Source: Cass Information Systems Inc., ACT Research Co.

The Cass Freight Index reported that shipments decreased 2.4% year over year to 1.081 from 1.108. It also decreased 1.9% from 1.102 in September. The report concluded the results indicate that private fleet growth continues to affect for-hire demand. It noted, too, that the ongoing softness in shipments comes as Class 8 tractor sales rebounded from supply constraints in the second quarter.

“The slow, and choppy, climb off of the bottom continued in October,” ATA Chief Economist Bob Costello said. “Since hitting a low in January of this year, tonnage is up a total of 3%, plus the index is up sequentially in three of the last four months. No doubt the freight market has improved — albeit slowly — over the course of the year.”

ATA calculates its monthly tonnage index based on membership surveys. The feedback primarily comes from contract freight rather than spot market freight. In calculating the index, 100 represents 2015.

Want more news? Listen to today's daily briefing below or go here for more info: