Staff Reporter

ATA Truck Tonnage Drops 2.1% in September After Gains

[Stay on top of transportation news: Get TTNews in your inbox.]

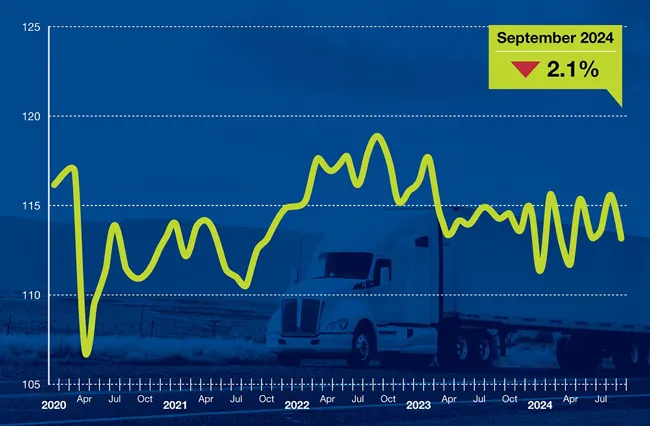

Freight tonnage ended two months of sequential gains with a decline in September, American Trucking Associations reported Oct. 22.

The ATA For-Hire Truck Tonnage Index decreased 2.1% to 113.2 from August. The index also declined 0.9% compared with September 2023. August saw the only year-over-year gain in 2024 except for May, though that figure was adjusted downward from initial reports.

“After increasing a total of 2.1% in July and August, tonnage fell by that amount in September,” said ATA Chief Economist Bob Costello. “Freight has been very choppy this year, but despite the latest drop, tonnage is up 1.8% since hitting a low in January. No doubt, the climb up has been slow and difficult as manufacturing activity remains flat, but the trend is up, not down.”

ATA calculates its monthly tonnage index based on membership surveys. The feedback primarily comes from contract freight rather than spot market freight. In calculating the index, 100 represents 2015.

(American Trucking Associations)

“What I’m seeing is a kind of return to a pre-COVID normal,” said Jonathan Phares, assistant professor of supply chain management at Iowa State University. “Now where we are is back to where we were around the time between 2010 and 2017, which were not bad economic times, they just didn’t see that explosive growth that we saw in the couple of years before COVID and in the couple of years after.”

Phares views the recent declines as the market leveling out closer to pre-pandemic conditions. However, he highlights that the freight market is significantly more volatile this time. He noted this volatility is creating challenges for carriers, including difficulty determining appropriate capacity levels.

“We’re in a place that’s not abnormal for the past decade,” Phares said. “We talk about how it’s fallen. But in reality, it kind of seems like a return to normal.”

Phares added that freight market balancing became apparent in spring 2024, and volatility has been settling down recently. This trend has led to more predictability in the market, pushing it closer to historical patterns.

“At the beginning of the year, we were seeing a lot more volatility month to month,” Phares said. “We’re still seeing month-to-month volatility. But the extremes are less. So we are seeing a little bit more balancing or leveling out in the freight, which is more characteristic of how the trends have been in the past as well.”

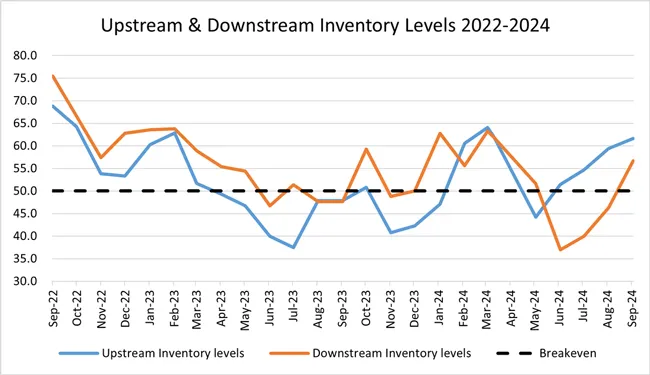

(Logistics Managers' Index)

The Logistics Managers’ Index registered 58.6 for September compared with 56.4 in August. The overall index has increased for 10 consecutive months, with the latest figure reaching its highest level since September 2022. The index authors view this as strong evidence that the logistics industry is back on solid footing.

“We saw a continuation of August’s trends in September as inventory levels increased (+4.1) to 59.8,” LMI said in its report for September. “This is largely driven by the long-expected restocking of downstream retailers. After several months of contraction, downstream respondents are reporting expansion for inventory levels at a rate of 55.7.”

The index measures the rate of change on a scale to 100. An LMI reading above 50 indicates expansion in the logistics sector, while a reading below 50 indicates contraction. It’s compiled by researchers at Arizona State University, Colorado State University, Florida Atlantic University, Rutgers University, the University of Nevada-Reno and the Council of Supply Chain Management Professionals.

The Cass Freight Index, another measure of the North American freight market, reported that shipments decreased 5.2% year over year to 1.102 from 1.163. It also decreased 1.7% from 1.121 in August. The report concluded that the decline, coming as Class 8 sales jumped in the third quarter, may indicate continuing private fleet insourcing.

Want more news? Listen to today's daily briefing below or go here for more info: