Staff Reporter

Class 8 Sales Continue Trending Below Year-Ago Period

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. Class 8 retail sales in June experienced their 11th consecutive month of year-over-year declines, according to data from Wards Intelligence.

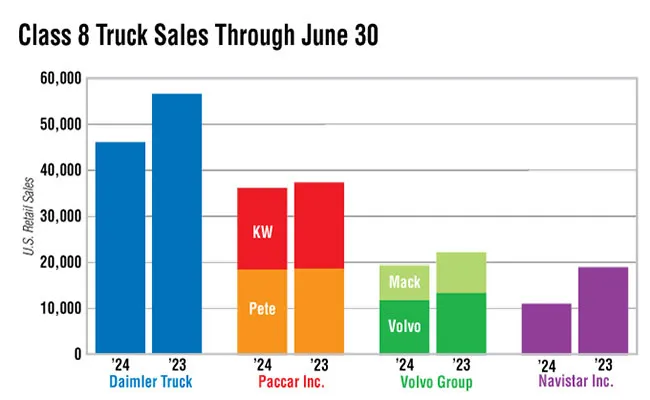

Sales decreased 24.7% to 18,134 units from 24,085 in June 2023. They also fell 8.2% from 19,764 units reported in May. Year-to-date sales are down 16.4% to 113,529 units from 135,802. Five of the seven major brands saw lower sales year-over-year in June.

“The OEMs are constrained on the number of trucks they can sell because of a shortage of mirrors in the space,” ACT Research Vice President Steve Tam said. “So while the trucks are substantially complete and in large part being counted as produced, what we’ve seen is almost an accumulation of inventories.”

Tam added that truck manufacturers are trying to work through the growing inventories. But the challenge has been that the supply of mirrors was tight before the current shortage, so there wasn’t excess capacity.

Visser

“June’s sales result is right at the pre-pandemic historical average for the month,” said Chris Visser, director of specialty vehicles at J.D. Power. “Eighteen thousand trucks is typical of a market on cruise control, not doing particularly great but also not particularly weak.

“The second half of the year is typically stronger than the first half for deliveries, but with orders depressed and pre-buy anticipation ramping up, any notable increase in model-year 2025 deliveries would be a bit of a surprise at this point.”

Freightliner, a brand of Daimler Truck North America, claimed the largest market share with 6,074 trucks, accounting for 33.5% of all sales for the month. That still was a 32.4% drop-off from 8,991 the prior year. Western Star, also a DTNA brand, experienced the largest year-over-year percentage increase in truck sales of the major brands at 13.2% to 831 units from 734.

Source: Wards Intelligence; graphic: Transport Topics

“In 2023, the on-highway segments experienced robust activity driven by pent-up demand accumulated in previous years, ”said David Carson, senior vice president of sales and marketing at DTNA. “As we stabilize, we’re witnessing the anticipated aftermath of an elevated market. Adding to this expected downtrend, additional challenges, such as mirror supply disruptions, impacted sales numbers.”

Carson added that these disruptions are mostly resolved, though he does expect impacted units to show up in the sales figures next month. But despite these challenges, there still have been positive signs, such as the heavy-duty vocational segments seeing significant growth in year-to-date sales. This is especially true for the vocational Western Star 47X and 49X models.

Carson

“We’re seeing encouraging signs in the market, particularly with strong vocational truck demand,” said Jonathan Randall, president of Mack Trucks North America. “Our on-highway sleeper business has seen softening but appears to have leveled off for our customers. In addition, other business segments remain steady, including regional haul, refuse and medium-duty.

“Recent vehicle sales may have been impacted by the CDK software breach impacting dealer networks across the U.S. We anticipate pent-up demand will lift sales as dealers work through the backlog.”

Mack Trucks sales decreased 21.9% to 1,362 from the 1,744 units reported during the year-ago period. Volvo Trucks North America sales decreased 17.1% to 1,991 units from 2,403. Mack and VTNA are brands of Volvo Group.

Kriete

“This [year-over-year] decrease is unfortunate and definitely puts a strain on the dealer network’s business. However, it’s still in line with forecasts made over six months ago,” said David Kriete, president of Kriete Truck Centers. “OEMs and the network are well-prepared for this 15-30% drop in overall business. Vocational markets remain strong, and after the summer months, we’re hopeful that the longhaul market begins its return to ‘normal.’ I’m optimistic that the YOY decrease will ease as we head deep into Q3 and in to Q4.”

Navistar’s International brand saw a 49.6% drop in sales to 1,725 units from 3,426. Peterbilt Motors Co. sales increased 1.6% to 3,294 units from 3,243. Kenworth Truck Co. saw sales fall 19.4% to 2,830 from 3,512. Peterbilt and Kenworth are Paccar Inc. brands.