Fleets Persevere Through Down Market With Care and Creativity

[Stay on top of transportation news: Get TTNews in your inbox.]

With an overabundance of freight-hauling capacity, weak rates and higher operating costs all contributing to a challenging market for trucking companies, fleet operators have been increasing efficiency, embracing technology and collaborating with shippers to survive.

“I can’t ask customers for more pennies right now. If I can find ways to save pennies, it is the same thing,” said Royal Jones, CEO of truckload carrier Mesilla Valley Transportation. “Every penny a mile is $150,000 a month.”

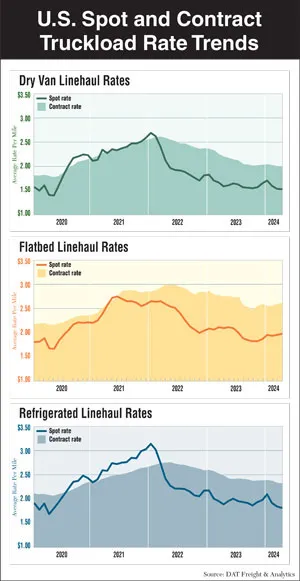

From the surge in freight demand during the economic rebound from the COVID-19 pandemic to the ongoing market downturn that took hold in 2022, trucking hasn’t had a normal freight market for the better part of four years, said Dean Croke, principal analyst at DAT iQ, the freight data operation of DAT Freight & Analytics.

Conditions today feel similar to late 2018 and 2019, with a prolonged period of low demand, he said.

“Shippers still have pricing power. They’re still driving down contracts on [requests for proposal] because there is still capacity in the market,” Croke said.

Spot rates, meanwhile, are nearly identical to where they were in 2019.

“We’re seeing soft demand for manufacturing, food, chemicals and steel. Even though housing starts were up, still not enough demand to move the rate needle,” Croke said. “There is a lack of confidence because we don’t know when the market will turn. That all supports a very soft freight market that is oversupplied on capacity.”

The total number of motor carrier authorities spiked during the pandemic as an influx of small carriers entered the industry. While some of those new businesses have since exited the market, a significant portion remain.

See the 2024 Top 100 rankings

►Freight Recession Squeezing Carriers

►Fleets Persevering in Down Market

►An Immigrant's Journey to Trucking

►A. Duie Pyle's Centennial

►Interactive Map

►Sector Lists Reflect Market Weakness

Sector Rankings

LTL | TL/Dedicated

Intermodal/Drayage

Motor Vehicle/Driveaway

Tank/Bulk | Air/Expedited

Refrigerated | Flatbed/HS

Package/Courier | Mail

Household Goods/Commercial

“On the supply side, the general headline is we still have more trucks than loads at a market level,” Croke explained, adding that carriers made unprecedented profits during the economic rebound from the pandemic, allowing them to survive in today’s weaker market.

However, there have been several notable carrier bankruptcies during the ongoing downturn, including less-than-truckload giant Yellow Corp. and Arnold Transportation Services.

Lindsay Bur, senior economic analyst at American Trucking Associations, said there was almost a 7% increase in the number of carriers leaving the industry from December 2022 to December 2023, but that rate is slower than it had been in previous downturns.

“It is happening, but it is prolonged and will probably take the rest of 2024 to see those carriers exit the market,” Bur said while speaking at an industry event.

Part of the reason capacity is leaving slowly has to do with banks that own the liens on equipment and their reluctance to repossess that equipment. During the recovery from the pandemic, buyers paid a premium for Class 8 tractors at a time when freight demand exceeded industry capacity.

That equipment factor also is contributing to those carriers’ willingness to take whatever loads they can get.

“They have to run hard at lower rates just to pay their financial insurance,” Croke said.

If used Class 8 truck prices go up, ATA’s Bur said she expects to see a significant number of exits due to bank repossessions.

Higher Costs and Lower Rates

Carriers are not only dealing with low rates but a significant increase in operating costs. Wages, fuel prices, insurance premiums, equipment costs and interest rates have climbed in recent years.

“A new truck today costs so much more than it did five years ago, and with interest being so high, your cost per month on a 60-month loan is $800 to $1,000 a month more than it was,” said Jones of Mesilla Valley Transportation. “The costs that went up didn’t go down because rates went down.”

In some cases, broker are offering rates that are about 20% to 30% lower than carriers’ costs, Jones added.

Mesilla Valley Transportation, which ranks No. 73 on the Transport Topics Top 100 list of the largest for-hire carriers in North America, turns down freight daily because rates are too low.

However, Jones said his company will sometimes accept lower rates on broker boards if it helps move trucks to where they are needed for contract freight.

“Thank God for us we have 70% contract,” he said. “If I was running 100% spot, it wouldn’t work.”

Amid a soft freight market, fleets such as A. Duie Pyle emphasize the importance of carrier performance to overall transportation costs. (A. Duie Pyle)

John Luciani, chief operating officer of less-than-truckload solutions at A. Duie Pyle, said pricing is both an art and science.

The carrier will pass on a piece of business if the rate is too low but tries to figure out a way to say yes.

“We’re looking for customers to give us supply chain data, and then we’ll create a solution,” he said.

Nonetheless, every customer needs to contribute to profitability.

“At the end of the day, if we’re not profitable, that isn’t good for anybody,” Luciani said, adding that customers need to think about the “real cost outside of the four corners of the freight invoice.”

That includes not only freight rates but also carrier performance.

“We are 98% on time and our claims ratio is about 0.26% of revenue,” Luciani said.

A. Duie Pyle ranks No. 57 on the for-hire TT100.

Chris Kelley, senior vice president of operations at Old Dominion Freight Line, said it is important to educate customers on the total cost of transportation.

“Sometimes, there is an initial move to a lower-cost option rather than looking at the value,” he said.

Chargebacks, damages and delays all can impact the total cost to the shipper.

“We have a value calculator to talk about some of the things we do to take into account the cost of transportation and how to maximize every dollar you’re spending,” Kelley said.

Old Dominion ranks No. 8 on the for-hire TT100.

When pricing pressures are not sustainable, it is better to pass on an opportunity rather than accept a margin that will not allow for a reasonable return, said Kent Williams, executive vice president of sales and marketing at Averitt.

Fortunately, the best customers understand the value of a stable partnership.

“They stick with us even when market conditions could allow them to seek more competitive rates elsewhere,” he said.

Carriers like Averitt may become more selective when market conditions call for a higher emphasis on margins. (Averitt Express)

One of the biggest operational challenges for carriers in a down market relates to maintaining profitability through shipment density, Williams added.

“As the geographic area a carrier serves remains constant, when market conditions slow down, a carrier’s density decreases, which can negatively impact efficiency and margins,” he said.

In slower markets, it can be difficult to sustain the usual level of hours and miles that professional drivers can expect during busier times.

Williams said Averitt reallocates resources from slower markets to those with more activity to keep drivers moving and associates employed, which ensures the carrier is prepared when market conditions rebound.

Averitt ranks No. 25 on the for-hire TT100.

Boosting Efficiency

There are two ways for transportation companies to save money — cut costs or create efficiencies, said Josh Allen, chief commercial officer for ITS Logistics, a dedicated carrier and supply chain services provider.

“We’ve focused on creating efficiency through technology, network optimization and improved asset utilization,” he said, adding the company increased its load count 40% year-over-year in the first quarter.

Mesilla Valley Transportation has reworked its fuel optimizer and has eliminated one stop per truck per month, which adds up to 1,700 fewer stops monthly.

“We are increasing our miles per day per truck by minimizing stops. We paid less for fuel, didn’t stop as much and cut down on incidents — 60% of incidents occur at a truck stop,” Jones said. “Every time you stop, you waste an hour. That is 60 miles. I’d rather put those 60 miles on the odometer.”

The carrier also has used technology to calculate the return on investment of using toll roads.

“In the hustle and bustle, we were spending $30,000 to $40,000 on tolls roads,” Jones said. “We started looking at how many minutes difference it was to avoid a toll. In some cases, it was three minutes.”

Mesilla Valley Transportation now avoids tolls if there are only minimal time savings. Toll charges in the Dallas area alone have been cut in half, Jones said.

Old Dominion works with shippers to identify efficiencies that can reduce costs in the supply chain.

“Partnering to take cost out of our network helps them take costs out of their network,” Kelley said. “Sometimes it can be something as simple as changing the label on products. A small change in packaging might change loadability.”

Old Dominion also encourages customers to use e-manifests and electronic bills of lading, which provide detailed information, increase accuracy and cut down on labor.

A. Duie Pyle also is finding ways to wring more efficiency out of its operations.

“In a down market, we’re always looking to eliminate tasks that don’t bring any value,” Luciani said.

Employees working in day-to-day operations often have the best solutions, so A. Duie Pyle maintains an email address where they can submit their ideas.

One recommendation to come from the email inbox was an idling policy.

“We have an active idle policy, measure intertrip idle and full-trip idle, and have built a little bit of a competition among the terminal level and driver level,” Luciani said. “It has reduced costs and helped improve fuel consumption.”

The Custom Cos., a diversified trucking company based in Northlake, Ill., is working to reduce touchpoints to help cut costs.

“It is amazing when you look at the life cycle of an LTL shipment and how many individuals touch it. In one service center alone, there are five touches,” said Joseph Klikas, the company’s chief experience officer. “That is where we see the most cost.”

Klikas said The Custom Cos. is talking with shippers and identifying opportunities to deliver freight directly to the market.

Corey Cox of the Tandet Group of companies discusses how early AI adopters are beginning to harvest the latest wave. Tune in above or by going to RoadSigns.ttnews.com.

“You can bring a lot of value to the client if you touch that freight as little as possible,” he said, adding that the company also focuses on the most profitable lanes. “We find that if you price in order to earn lanes that are most efficient, you net a greater gain there than pricing into areas you’re not necessarily good at.”

Klikas is using software from Carrier Logistics Inc. to help identify costs and streamline loads. Technology allows LTL carriers to get shipment data into their operating system earlier, enabling them to change linehaul schedules proactively, said Ben Wiesen, president of Carrier Logistics Inc. It also helps carriers monitor costs, which can change significantly as freight volumes fluctuate.

“It is one thing to know your costs today, but those costs are ever-changing. It is important to know them as you bid business,” Klikas said. “Even the most minor of shifts in cost can create a great shift in profitability based on the business and volumes you handled at that time.”

Equipment maintenance is another area where fleets, truck makers and technology vendors are focused on controlling costs.

Even seemingly minor maintenance problems can become costly if they aren’t addressed early.

“Low-key issues may not be enough to cause a diagnostic trouble code to trigger, but they can still have an impact on the overall fuel efficiency of a vehicle,” said Craig Vanderheide, director of product management for Intangles, a provider of predictive maintenance technology. “This 1-2% degradation in fuel efficiency can have significant effect on a fleet’s cost per mile.”

Investing in the Future

Even in a down market, investing in business improvements and new technologies can be important to drive future profits.

Parcel giant UPS Inc., which ranks No. 1 on the for-hire TT100, is working to enhance efficiency and minimize costs through its multiyear Network of the Future initiative.

“To help achieve our goals, we expect total capital expenditures between 2024 and 2026 to be between $17 billion and $18 billion, which is approximately 5.5% of revenue,” said Jim Mayer, senior director of media relations.

UPS is deploying new technologies, including increased automation and robotics, advanced RFID capability and artificial intelligence, he said.

ITS Logistics also is investing in capabilities and assets that will allow the company to create stronger relationships with customers.

Want more news? Listen to today's daily briefing above or go here for more info

“The rationale is, we’ve already made the investment in customer acquisition and support,” Allen said. “The more problems we solve, the stickier our solutions become and the more dollars we drive to the bottom line.”

Recent investments for ITS Logistics include the opening of its 1.1-million-square-foot distribution facility in Fort Worth, Texas, the launch of a Tech Innovation Center in Walnut Creek, Calif., and assets such as trailers, power units and chassis.

“That deeper capability set makes us a better partner for our customers and puts us in a strong position of growth for when the market turns,” Allen said.

Old Dominion also continues to seek out opportunities to gain a competitive advantage through its equipment and facilities.

“Even though things are slower, we can’t stop investing in our network,” Kelley said. “What we have done so well is strategically invest when others might be pulling back to give us capacity. As the market recovers, we always gain market share.”