Global Chips Battle Intensifies With $81B Subsidy Surge

[Stay on top of transportation news: Get TTNews in your inbox.]

Superpowers led by the U.S. and European Union have funneled nearly $81 billion toward cranking out the next generation of semiconductors, escalating a global showdown with China for chip supremacy.

It’s the first wave of close to $380 billion earmarked by governments worldwide for companies like Intel Corp. and Taiwan Semiconductor Manufacturing Co. to boost production of more powerful microprocessors. The surge has pushed the Washington-led rivalry with Beijing over cutting-edge technology to a critical turning point that will shape the future of the global economy.

“There is no doubt we’ve passed the Rubicon in terms of the tech competition with China, particularly on semiconductors,” said Jimmy Goodrich, senior China and strategic technology adviser to the Rand Corp. “Both sides have basically made this one of their top strategic national objectives.”

What began as concern over China’s rapid advances in key electronics blossomed into a full-scale panic during the pandemic, as chip shortages highlighted the importance of these tiny devices to economic security. At stake now is everything from the revitalization of U.S. tech manufacturing to the assertion of an upper hand in artificial intelligence to the balance of peace in the Taiwan Strait.

Because of President Biden’s leadership, we will once again design, manufacture, and produce the world’s most advanced leading-edge chips in United States. pic.twitter.com/rPs8kXu7XB — Secretary Gina Raimondo (@SecRaimondo) April 17, 2024

Chips spending by the U.S. and its allies marks a new challenge to Beijing’s decades of industrial policy — albeit one that will take years to bear fruit. The rush of funding has hardened battle lines in the U.S.-China trade war, including in places like Japan and the Middle East. It’s also giving a lifeline to Intel, the onetime global leader in chip manufacturing that in recent years has lost ground to rivals including Nvidia Corp. and TSMC.

Investment plans have reached a critical juncture in the U.S., where officials last month unveiled $6.1 billion in grants for Micron Technology Inc., the largest American maker of computer-memory chips. That was the final multibillion-dollar grant for an advanced chipmaking facility in the US, capping a flurry of commitments nearing $33 billion to companies including Intel, TSMC and Samsung Electronics Co.

President Joe Biden opened that funding spigot with his signature 2022 CHIPS and Science Act, promising a total of $39 billion in grants for chipmakers, sweetened by loans and guarantees worth an additional $75 billion plus tax credits of up to 25%. It’s the heart of his high-stakes bid to revive domestic semiconductor production — especially of leading-edge chips — and deliver a rush of new factory jobs to help convince voters he deserves reelection in November.

Those investments by the U.S. seek to do more than just counter China, which still trails the rest of the world by several generations in advanced semiconductor technology. They also aim to close the gap on decades of state-directed incentives from Taiwan and South Korea that have made those places centers of the chip industry.

The spending spree likewise is fueling rivalries among the U.S. and its allies in Europe and Asia, all chasing a piece of the growing demand for devices powering advances in AI and quantum computing.

President Joe Biden listens to Intel CEO Pat Gelsinger (left) as Intel factory manager Hugh Green listens, during a tour of the Intel Ocotillo Campus, in Chandler, Ariz., March 20. (Jacquelyn Martin/Associated Press)

“Technology is moving fast,” Commerce Secretary Gina Raimondo, who’s leading the administration’s semiconductor charge, said at a conference in Washington last month. “Our enemies and competitors, they’re not moving slowly. They’re moving fast, so we have to move fast.”

Across the Atlantic, the European Union has forged its own $46.3 billion plan to expand local manufacturing capacity. The European Commission estimates that public and private investments in the sector will total more than $108 billion, mostly in support for large manufacturing sites.

Europe’s two largest projects are in Germany: an Intel manufacturing plant planned in Magdeburg worth about $36 billion and receiving nearly $11 billion in subsidies, and a TSMC joint venture worth roughly $11 billion, half of which will be covered by government funds. Even so, the European Commission has not yet given final approval for state aid to either, and experts caution that the bloc’s investments will not be enough to achieve its goal of making 20% of the world’s semiconductors by 2030.

Other European countries have struggled to fund major projects or attract companies. Spain announced in 2022 that it would put nearly $13 billion toward semiconductors but has only doled out small amounts to a handful of companies owing to the lack of a semiconductor ecosystem in the country.

Emerging economies are also looking to break into the chips game. India in February approved investments powered by a $10 billion government fund, including a Tata Group bid to build the country’s first major chipmaking facility. In Saudi Arabia, the Public Investment Fund is eyeing an unspecified “sizable investment” this year to kick off the kingdom’s foray into semiconductors as it seeks to diversify its fossil fuel-dependent economy.

In Japan, the trade ministry has secured about $25.3 billion for its chips campaign since its inception in June 2021. Of that sum, $16.7 billion has been allocated for projects including two TSMC foundries in southern Kumamoto and another foundry in northern Hokkaido, where Japan’s homegrown venture, Rapidus Corp., aims to mass produce 2 nanometer logic chips in 2027.

Prime Minister Fumio Kishida is targeting a total $64.2 billion investment, including sums from the private sector, with a goal of tripling sales of domestically produced chips to about $96.3 billion by 2030.

Seoul, by contrast, has avoided direct financing and subsidies like those embraced by Washington and Tokyo, preferring to act as a guiding hand to its deep-pocketed chaebol. In semiconductors, the South Korean government plays a supporting role in an estimated $246 billion of spending — part of a broader vision for homegrown technology from EVs to robotics. That effort stands to get a boost from a $7.3 billion chips program that the finance ministry said on May 12 would be unveiled soon.

One potential danger overshadows the global surge of government support: creating a glut of chips.

“All of this investment into manufacturing driven by government investment and not primarily market-driven investment could eventually lead to a situation where we have more capacity than we need,” said Bernstein analyst Sara Russo. However, that risk is mitigated by the length of time it will take for the planned new capacity to come online.

For now, companies like Nvidia, Qualcomm Inc. and Broadcom Inc. lead the world in design of chips vital to key fields such as artificial intelligence. But there’s debate on how wide that lead is. Some experts argue that China is years behind, while others insist that the world’s second-largest economy is on the cusp of catching up.

China now has more semiconductor plants under construction than anywhere else in the world, building production of less-glamorous legacy chips while amassing the expertise needed for a home-grown technological leap. It’s also working on domestic alternatives to Nvidia’s AI chips and other advanced silicon.

“You’re seeing an alignment between the Chinese private sector and the Chinese state’s goals, in that the Chinese private sector has to go domestic to risk-mitigate,” said John Lee, director of East West Futures Consulting.

To retread or not to retread, that is the question. For some maintenance managers, the debate between purchasing new tires or retreads is constant. In this episode, host Michael Freeze finds answers about tires with Alex Aguilar, senior training specialist at Bridgestone Americas. Tune in above or by going to RoadSigns.ttnews.com.

The amount of money Beijing is pouring into the sector likely dwarfs U.S. spending. China was on track to spend more than $142 billion, the Washington-based Semiconductor Industry Association has estimated. As part of that effort, the government has been raising another $27 billion for what’s known as the Big Fund to oversee state investments in scores of companies, including local chipmaking champions Semiconductor Manufacturing International Corp. and Huawei Technologies Co.

Another sign of Beijing’s determination comes from corporate records in China. According to a Bloomberg News analysis of hundreds of companies in the official corporate database Tianyancha, there are more than 200 semiconductor firms in the country with registered capital of more than $61 billion. Much of that comes from state-affiliated entities, and all of it should translate into real capital deployed.

Beijing and local governments do not disclose their overall semiconductor funding, although certain companies disclose some of the subsidies they receive. Estimates vary widely because money comes from state-backed national funds, local government financing and a wide array of incentives and tax breaks.

China’s efforts have been slowed by a wall of restrictions imposed by the U.S. to deny its geopolitical rival access to the latest semiconductors. The Biden administration is enlisting allies in Europe and Asia to adopt export controls on sophisticated equipment needed to make the most advanced chips.

“We cannot allow China to have access for their military advancement to our most sophisticated technology,” Raimondo said in Manila in February, when she announced that American chip companies would invest $1 billion in the Philippines. “We will do whatever it takes to protect our people, including expanding our controls.”

Prior to the export crackdown, China was making progress, led by Huawei. The company’s abilities in designing some types of chips were beginning to rival those of the best American companies before it was blacklisted by the U.S. in 2019, leaving its processor designers with a far-smaller business to finance their innovation efforts.

SMIC, China’s top chipmaker, joined Huawei on the U.S. government’s so-called restricted entities list in 2020. Two years later, Washington hit Beijing with export controls designed to further block China’s access to the latest manufacturing technology. The Biden administration is now trying to close remaining loopholes, including on equipment repair, though some U.S. allies including the Netherlands and Japan are balking.

The U.S.-led crackdown has provided “a huge incentive for Chinese firms to improve their capabilities, move up the value chain, collaborate amongst themselves, and galvanize more government support to firms like Huawei that are driving the industry forward,” said Paul Triolo, a former U.S. government official who specializes in China and technology policy at Albright Stonebridge Group.

Huawei made a significant leap in August when it unveiled a new Mate 60 Pro smartphone featuring a 7-nanometer processor from SMIC — a feat that Biden administration officials had hoped to keep beyond China’s reach. The release came during Raimondo’s highly anticipated visit to China, irritating the secretary and quickly prompting an investigation by the Commerce Department.

U.S. officials have since said that the chip lags behind foreign components in both performance and yield. It was manufactured using American and Dutch tools, Bloomberg has reported, underscoring China’s dependence on Western technology.

Even so, the Biden administration is still weighing its response: Officials have said that SMIC may have violated U.S. law if it produced the chip for Huawei, and they’re considering sanctioning a network of Chinese tech firms that they fear could also manufacture processors for the telecom giant.

Looming over the global chips push is the risk of a Chinese invasion of Taiwan that the Pentagon estimates Beijing would be ready to undertake as soon as 2027. The island — regarded by China as a renegade province — is home to industry leader TSMC and supplies 90% of the world’s most advanced chips.

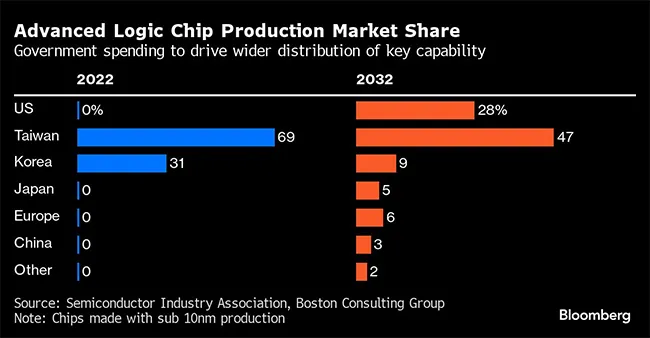

The threat of chips supply disruption is motivating Raimondo, a former Rhode Island governor and ex-venture capitalist who wants U.S. factories to make 20% of the world’s most-advanced logic semiconductors by the end of the decade. The SIA says the U.S. is on track to capture 28% of that market by 2032. That’s up from zero percent today — and would make the U.S. the second-biggest producer, behind only Taiwan.

The race to construct those factories also carries the added stakes of Biden’s pursuit of a second term, putting his promise of a manufacturing revival at the heart of his re-election campaign against Donald Trump.

Projects in Arizona — a state seen as crucial for victory in November — have secured billions of dollars in awards. Yet it will take until well after the U.S. election for manufacturing plants planned there by Intel and TSMC to be built and start producing chips — testing voters’ patience to see the promised jobs.

Want more news? Listen to today's daily briefing above or go here for more info

So far, Trump has yet to spell out his plans for semiconductors — including the CHIPS Act funds that won’t begin flowing until sometime around Election Day after a long period of due diligence. While in office, Trump was responsible for winning TSMC’s commitment to build its first advanced plant in the U.S. in 2020, and he imposed tech-related sanctions against China, including on Huawei.

Trump is also threatening tariffs of up to 60% on Chinese goods if he becomes president again. That risks triggering a much more forceful response from Beijing, Triolo said, from targeting American companies in China to restricting exports of materials critical to semiconductors and other strategic technologies.

“It doesn’t really matter who is president going forward,” Lee said. “The U.S.-China tech war is going to get worse, not better.”

Written by Mackenzie Hawkins, Ian King, Jillian Deutsch, Yoshiaki Nohara and Yuan Gao