Bloomberg News

Green Diesel Is Suddenly a Booming Business

[Stay on top of transportation news: Get TTNews in your inbox.]

In the hottest U.S. labor market in decades, the hottest job of them all right now might be trading fats.

That’s right — animal fats. And greases, too.

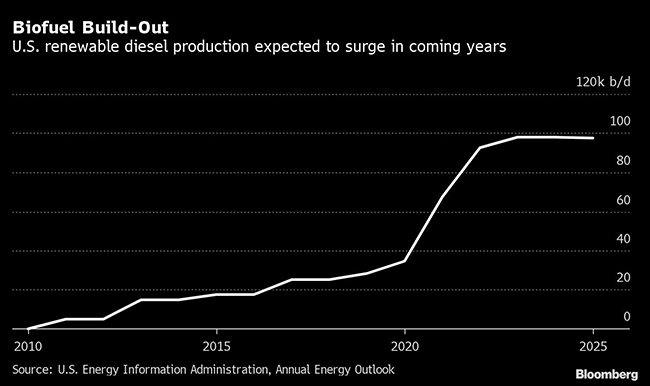

They are, it turns out, essential ingredients in the production of climate-friendly diesel, a business that is suddenly booming as fossil-fuel giants such as Exxon Mobil Corp. and Chevron Corp. race to cut their emissions and take advantage of incentives like those laid out by California and Canada.

Prices for vegetable oils, used cooking oil and fats are soaring and, with them, so too are salaries for those who can obtain the massive quantities needed. It’s a job that requires scores of relationships with farmers, restaurant owners and processing plant managers all across America.

Few traders have big enough Rolodexes, and those that do are now commanding as much as $800,000 a year. That might not compare, of course, to the kind of money a star Wall Street bond trader can make, but for a vegetable oil expert, that’s double or even triple the usual pay. For decades, trading fats was a niche, obscure part of the commodities business that no one thought too much about.

“They were just byproduct guys,” said Patrick Bowe, CEO of The Andersons, a 75-year-old crop trading company based in Maumee, Ohio. Now, he says, “they have the hottest jobs.”

Bowe himself recently set up a desk just to trade the ingredients.

In addition to Big Oil jumping on the green-diesel bandwagon, more companies are making plans to achieve net-zero emissions by the half-century mark, and increasing use of biofuels is key. The trend is driving up demand for vegetable oils, and prices for used cooking oil and animal fats have touched “unheard of” levels over the past year, according to David Elsenbast, president of Iowa-based AgriBio Consulting, which specializes in helping customers navigate such supply chains.

The used cooking oil market in the U.S. has soared from around a $700 million a decade ago to as much as $2.5 billion this year, Elsenbast estimated.

The scramble for these so-called “feedstocks,” or ingredients that go into making biofuels, is likely to intensify as the war in Ukraine disrupts trade.

Fossil fuel companies are learning just how different trading crude oil is from the Wild West-like world of green diesel. While buyers and sellers of vegetable oils, used cooking oil and animal fats are found across the agriculture and food sectors, only a couple of handfuls of U.S. traders are deft in all of them.

Unlike petroleum, which spews from the ground nonstop, flows through pipelines and traded in huge quantities, biofuel feedstocks vary widely in availability and must be sourced from scores of farms, restaurants and processing plants. The traders also deal in relatively small amounts of product moved by truck, rail or barge routes that are vulnerable to supply chain disruptions from driver shortages to excessive ice.

“The complexity and broad knowledge base to execute these moving parts simultaneously reduces the qualified pool of traders for companies looking to build out their trading desks,” said Billy Burns, a risk management consultant at StoneX Financial Inc. who specializes in fats, oils and greases.

To make renewable diesel, the chemical makeup of natural fats and oils is changed in a process involving the use of high-pressure hydrogen and the removal of oxygen. The result is a fuel that can be dropped into existing pipelines and engines as a direct replacement of its petroleum counterpart.

To help catch up, fossil fuel companies are starting to simply acquire biofuel makers. Petroleum juggernaut Chevron Corp. plans to purchase Iowa-based Renewable Energy Group Inc. for $3.15 billion, or nearly 10 times the company’s estimated profit this year.

Want more news? Listen to today's daily briefing above or go here for more info

“Having that feedstock system and those relationships were a big driver for value in the deal,” said John Campbell, managing director of Ocean Park, a boutique investment bank that specializes in the biofuels industry.

Chevron’s takeover offer came months after Renewable Energy Group’s CEO Cynthia “CJ” Warner warned of legal action by invoking the employee’s noncompete agreement to block a top trader from accepting a lucrative job offer from an oil refiner, according to people familiar with the matter. The move underscored the increasing competition for talent.

Gregory Broussard, global head of financial trading for the risk management arm of Cargill Inc., one of the world’s biggest agriculture companies, recently put together an environmental product trading desk and made the hiring of a feedstock expert a top priority.

“Everybody needs a trader,” he said.

—With assistance from Dominic Carey.