Services Gauge Drops to Three-Year Low

[Stay on top of transportation news: Get TTNews in your inbox.]

America’s service industries joined manufacturing in taking a big step back last month, fueling concerns that the global slowdown and trade war are weighing more on the broader economy. Stocks, the dollar and Treasury yields all fell after the report.

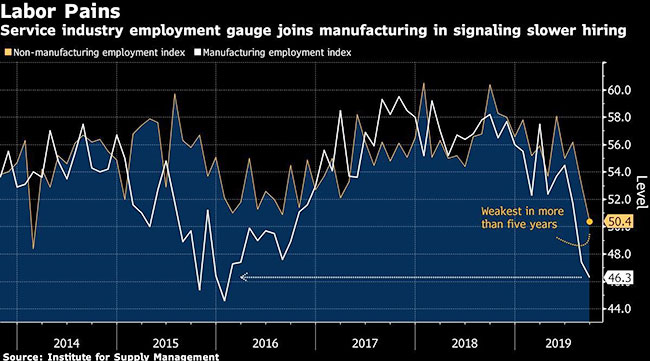

The Institute for Supply Management’s nonmanufacturing index dropped 3.8 points to 52.6 in September, the lowest since August 2016 and well below the most pessimistic forecast in a Bloomberg survey, according to data Oct. 3. Growth in orders and business activity slowed abruptly, while the employment gauge registered its weakest print in more than five years.

The weakening in U.S. services mirrored developments in Europe, where Germany registered a sharp slowdown in services activity. IHS Markit reported its gauge dropped to a three-year low of 51.4 in September from 54.8 a month earlier.

The same forces that continue to hammer away at U.S. manufacturing appear to be gathering a bigger foothold in the service industry, which makes up the majority of the economy and accounts for the biggest share of the labor force. Investors increased bets Oct. 3 that Federal Reserve officials will cut borrowing costs this month for a third straight meeting.

“These data move the needle into the idea that we are starting to see some spillover into the broader economy,” said Kevin Cummins, senior U.S. economist at NatWest Markets.

Greater weakness, if sustained, may also weigh on President Donald Trump’s re-election prospects in 2020 and could invite Democratic candidates to challenge his economic policies.

Recent economic growth has hinged on the American consumer at a time when businesses are cutting back on capital investment. Friday’s employment report, which is projected to show moderate job and wage growth, will update policymakers on how households are positioned to sustain their spending.

The ISM’s gauge of services employment decreased to 50.4, the lowest level since February 2014 and just above a reading of 50 that indicates firms are neither adding to nor reducing their payrolls.

The pullback in hiring doesn’t bode well for the Labor Department’s monthly employment report. Economists expect 148,000 jobs were added to headcounts in September.

The services employment gauge could reflect both difficulty finding workers, as well as slack demand. Anthony Nieves, chair of the ISM nonmanufacturing business survey committee, told reporters Oct. 3 that “there’s a combination of things going on in employment.”

“It’s just tough getting workers to fit certain open positions,” he said. “There has been some pullback as well by the respective companies.”

The group’s measure of prices paid by nonmanufacturing industries climbed to 60 in September. The import gauge sank into contraction at 49 while the export index improved to 52.

Want more news? Listen to today's daily briefing: