Bloomberg News

Target Plummets Most Since 1987 as Inflation Saps Margins

[Stay on top of transportation news: Get TTNews in your inbox.]

Target Corp. plunged the most since 1987’s Black Monday crash after becoming the second big retailer in two days to trim its profit forecast.

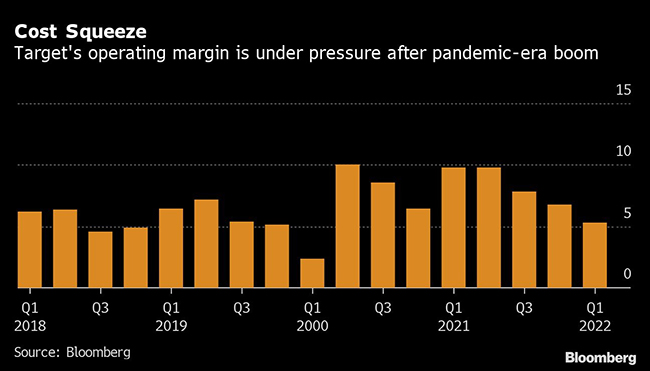

A surge in costs during the first quarter shows little sign of easing, said CEO Brian Cornell. Operating profit will amount to only about 6% of sales this year, 2 percentage points below the previous forecast, Target said May 18. And the company’s first-quarter adjusted profit missed the lowest of 23 analyst estimates compiled by Bloomberg.

“We were less profitable than we expected to be, or intend to be over time,” Cornell said in a briefing. “Looking ahead, it’s clear that many of these cost pressures will persist in the near term.”

Target’s worsening outlook echoes the darker panorama at Walmart Inc., which cut its profit forecast on May 17 and also posted its biggest stock decline since 1987. Target’s fuel and freight costs soared in the first quarter while a shift in consumer spending caused a sharper-than-expected slowdown in apparel and home goods sales, prompting the company to mark down bloated inventories.

“For the last two years, these guys have done nothing but blow out expectations,” said Brian Yarbrough, a retail analyst at Edward Jones. “In one quarter, that’s all wiped away. Now it’s a ‘show-me’ story.”

Target sank 25% to $161.61 at the close in New York, the worst plunge since Oct. 19, 1987, an infamous market collapse known as Black Monday. The shares had fallen 7% this year before the results, outperforming a 26% drop in an S&P 500 index of consumer-discretionary stocks.

Target is now trading at its lowest level since late 2020, giving back much of its pandemic-era gains. The share plunge dragged down other retailers as well, with Costco Wholesale Corp. dropping as much as 12%, Dollar General Corp. down as much as 14% and Dollar Tree Inc. tumbling as much as 18%. Those companies report results next week.

“The Target margin shortfall is more dramatic than what Walmart posted on Tuesday and clearly there are some industrywide/macro problems occurring,” Adam Crisafulli, an analyst at Vital Knowledge, said in a report. “Food/gas inflation are drawing dollars away from discretionary/general merchandise, forcing aggressive discounting to clear out product.”

On a conference call to discuss earnings, Barclays Plc analyst Karen Short questioned why Target was cutting its outlook so soon after an upbeat investor meeting in early March. Cornell said the company “did not anticipate the rapid change in conditions” since then.

Adjusted earnings tumbled to $2.19 a share during the three months ending in late April, the Minneapolis-based retailer said in a statement. Analysts had been expecting $3.06 on average.

Like Walmart, Target reported robust sales as U.S. consumers powered ahead despite the highest inflation in four decades. Target’s comparable sales climbed 3.3% in the first quarter, almost three times the average of analyst estimates compiled by Bloomberg. Revenue rose 4% to $25.2 billion. Wall Street had expected $24.3 billion.

But strong demand for food and beverages, beauty products and household essentials went along with “lower-than-expected sales in discretionary categories,” Target said. That’s a sign that shoppers are pulling back as they struggle to buy basic goods. Cornell said customers are buying more of Target’s store brands, a common strategy for shoppers seeking bargains.

The CEO also cited a “dramatic change in sales mix” as the COVID-19 pandemic abates. Customers who bought television sets or kitchen appliances last year might be purchasing restaurant gift cards or luggage for upcoming trips this year, he said.

The value of Target’s inventory surged 8.5% from the previous quarter and 43% from a year earlier. Retailers generally try to avoid piling up inventory because it can incur costs.

Want more news? Listen to today's daily briefing above or go here for more info

Target said inventory impairments were one of the causes of the company’s lower-than-expected profitability, and Chief Financial Officer Michael Fiddelke said additional markdowns are likely in the current quarter.

“Unexpectedly high costs” are another challenge, Target said. During the current quarter, operating margins will be similar to the first-quarter result of 5.3%, according to the Minneapolis-based company. Analysts had been expecting 9.5%.

Cornell and Fiddelke reiterated their confidence in Target’s long-term ability to earn operating margins of 8% even as they abandoned that goal for this year. Fiddelke said the company has been raising some prices, although it’s also trying to avoid turning off customers with big increases.

“We have seen prices rise, but it is the last lever we pull,” he said. “You’ll see us continue to use all the levers.”