Tesla Beats Delivery Expectations, Sending Shares Surging

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

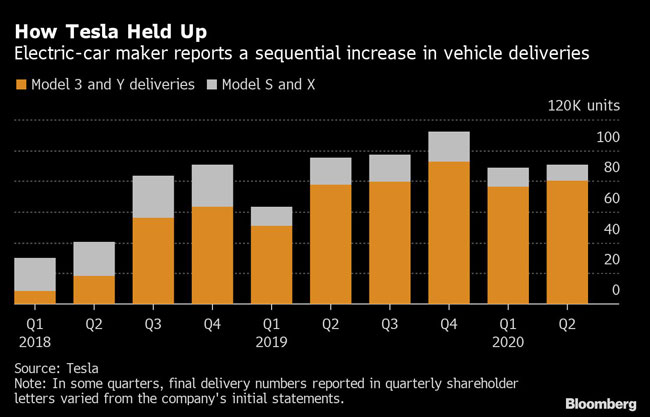

Tesla Inc. reported a sequential gain in quarterly deliveries that seemed improbable weeks ago, sending its stock surging toward Wall Street’s most bullish price target.

The electric-car maker handed over 90,650 cars to customers in the three months ended in June, exceeding analysts’ average estimate for about 83,000 in a Bloomberg News survey. Tesla delivered about 88,400 vehicles in the first quarter.

Tesla shares surged as much as 9.7% to $1,228 shortly after the open of regular trading, nearing the $1,250 target set July 2 by Wedbush Securities. The stock is on the verge of tripling this year.

CEO Elon Musk overcame a roughly seven-week shutdown of Tesla’s California car plant by ramping up output at its new factory near Shanghai. Localizing production in China is helping reach more customers in the world’s largest electric vehicle market by lowering prices. The period also was the first full quarter of deliveries for the Model Y crossover, which Musk has predicted will become Tesla’s top seller.

While deliveries were down almost 5% from a year ago, that’s a strong showing relative to the declines other automakers sustained due to the global pandemic that decimated vehicle demand in key markets.

“Tesla is winning because they have a product that is measurably better than both gas and electric competitors,” Gene Munster, a managing partner of venture capital firm Loup Ventures, wrote in a report. “It’s becoming more and more difficult to envision a scenario in which legacy automakers will find a way to meaningfully expand the small share of EVs that they have today.”

The next big question for Musk, 49, is whether the deliveries were enough to earn a quarterly profit. He suggested to employees earlier this week that avoiding a loss was possible.

“Breaking even is looking super tight,” the CEO wrote to staff in an email seen by Bloomberg. “Really makes a difference for every car you build and deliver. Please go all out to ensure victory!”

Musk has sent many end-of-quarter emails to rally employees and signal to investors, but Tesla hasn’t always followed through on his optimism. The then-record 97,000 deliveries Tesla reported for the three months that ended in September fell short of the 100,000 mark he floated in an email to workers.

If Musk is on the mark this time, Tesla could qualify for inclusion in the S&P 500 Index. To be eligible, the company needs to report positive quarterly earnings under generally accepted accounting principles. Beyond sales of cars, Tesla can recognize revenue related to its automated driving system, and it also sells emissions credits to other automakers.

“With strong Q2 volumes, GAAP profitability is now in focus and appears achievable, which could lead to inclusion in the S&P 500,” Ben Kallo, an analyst at Robert W. Baird who rates Tesla the equivalent of a hold, wrote in a report.

Analysts on average project Tesla will report a loss of about $1.80 a share on a GAAP basis for the quarter, according to data compiled by Bloomberg. But higher-than-projected vehicle deliveries would make profitability a “less radical” idea, Dan Levy, a Credit Suisse analyst, wrote in a report June 29.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More