Staff Reporter

Trucking Demand and Capacity Edge Closer to Equilibrium

[Stay on top of transportation news: Get TTNews in your inbox.]

The trucking industry is slowly rebalancing as the mismatch between freight demand and capacity returns to normal, according to experts.

The coronavirus pandemic brought with it significant supply chain disruptions, including consumers favoring goods over services. The resulting spike in freight demand and rates led to an increase in the number of drivers. But the eventual freight market downturn that began about two years ago created an oversupply of capacity relative to lower demand.

“Broadly speaking, freight demand trends are gradually improving,” said Carter Vieth, research associate at ACT Research. “Threat of another ILA [dockworkers] strike on January 15 has likely caused shippers to pull freight forward, and with tariffs on the horizon following the election, the pull-forward in freight is expected to accelerate further.”

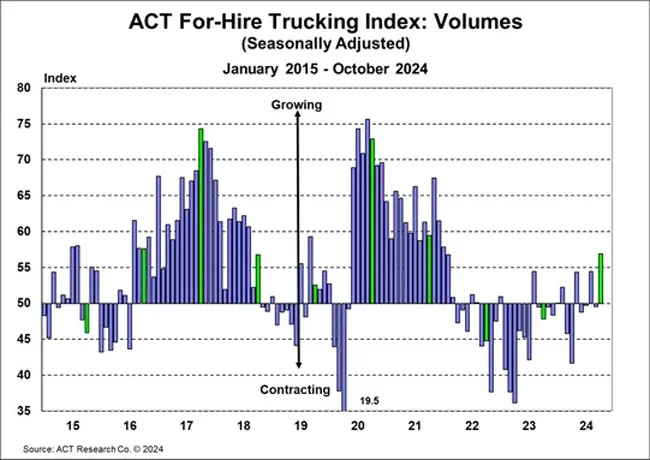

ACT Research noted its volume index increased 7.4 points month-to-month to 56.9 in October. At the same time, its capacity index decreased by 1.1 points to 49.7. This led to its supply-demand balance index increasing to 57.2 points sequentially from 48.8.

(Act Research)

“The trucking market is in a kind of limbo,” said Michael Castagnetto, president of North American Surface Transportation operations at C.H. Robinson. “I’d call it a state of stable, sustained oversupply. Freight demand hasn’t had many catalysts for growth.”

C.H. Robinson ranks No. 2 on the Transport Topics Top 100 list of the largest logistics companies in North America.

Castagnetto pointed to flat industrial production, fewer housing starts and reduced consumer spending to explain the lack of growth. He added that more carriers than expected are still hanging on, including those that were able to pay down their trucks or save money during the pandemic. They have also leveraged technology to find freight.

“One of the clearest signs of the state of the market is route guide depth,” Castagnetto said. “Typically, a sustained increase in route guide depth over several months would indicate the market is tightening and carriers could afford to be choosier about the freight they accept. Instead, our statistics show that route guide depth has remained flat.”

Lori Heino-Royer of Waabi discusses the latest developments, breakthroughs and key industry partnerships in autonomous trucking. Tune in above or by going to RoadSigns.ttnews.com.

Truckstop and Bloomberg Intelligence released a survey Nov. 12 that found owner-operators and small fleets are now seeing signs that the weak demand and low rates will improve. It noted that 6% more carriers expect spot rates to increase over the next three to six months, while 7% more expect higher volumes. But 15% still expect to leave trucking in the next six months.

“Despite greater optimism over the outlook, more carriers expressed an intent to leave the business than in our prior survey,” said Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence. “An acceleration in carrier exits could speed up the market’s return to equilibrium and provide a better backdrop for rates next year.”

Commercial Motor Vehicle Consulting noted in a report Dec. 3 that the rationalization process of excess capacity in linehaul applications has reached a neutral pricing environment. That means for-hire carriers lack the pricing power to increase freight rates, while shippers cannot lower them.

“We are completely balanced right now in the market,” said Jacob Faunce, carrier relations manager of procurement at E2open. “When Yellow went out of business back in July, they shed 34,000 jobs right off the market. If you look back at market intelligence reports, it looks like that between July and August, we shed about 37,000 jobs.”

Want more news? Listen to today's daily briefing above or go here for more info

Faunce noted that many first-time drivers with new commercial driver licenses flooded into the market during the pandemic. He added that retail sales growth and continued volumes from Asia and South America are the main reasons demand has stayed strong. Given driver capacity trends, he expects rates to flip soon.

“As carriers have been reducing the number of trucks in their fleets, large and small, and carriers have been exiting the market, they’ve been chasing this elusive demand that’s been moving sideways,” said Dean Croke, principal analyst at DAT Freight & Analytics. “It’s been like a moving target all year where capacity’s been trying to rebalance itself to where demand is, but demand has been really elusive.”

The elusiveness stems from high interest rates, changes in consumer spending and decreased home construction. Croke noted there hasn’t been a significant boost in demand as a result. But he has seen some positive signs like returning seasonality and the market predictability that brings. He also added that capacity continues to exit the market and rates started improving on a yearly basis in October.

“Even in November, we’ll lose another 7,000 carriers,” Croke said. “We’ve been averaging about 7,000 carriers exiting the market all year, every month. And that just speaks to this massive influx that came in 2021 and 2022. And by my accounts of the 480,000 carriers that have joined since June of 2020, 18% are still active in the market and that’s extraordinary.”