Turn Times at California Ports Slow One Minute in January

The average time to enter and exit the two largest containerports in the United States slowed one minute in January on a year-over-year basis, although the percentage of trips over two hours fell in the same period.

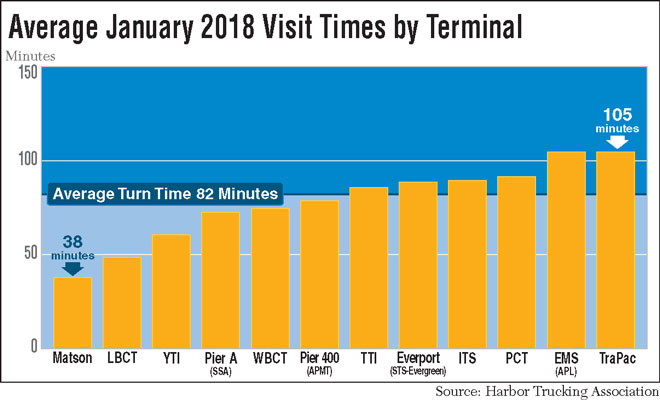

The average truck turn time was 82 minutes at the ports in Los Angeles and Long Beach, Calif., with 20% of trips longer than two hours. A year ago, the average was 81 minutes with 23.6% more than two hours. Two years ago, it was 104 minutes with 31.4% more than two hours.

The Harbor Trucking Association contracts with Geostamp to aggregate the data monthly using GPS and geofencing, measuring the minutes from when a trucker enters the queue outside the terminal to crossing the exit gate.

“Any time you can lower the amount of two-hour turns that’s good,” HTA CEO Weston LaBar said. He emphasized, however, that truckers would rather operate at a terminal with consistent turn times even if the mean was longer. “Especially now with ELDs, you want consistent turn times because then you can plan better.”

The quickest terminals were Matson at 38 minutes and Long Beach Container Terminal’s Middle Harbor at 49 minutes. At the Port of Los Angeles, Yusen International Terminals was quickest at 61 minutes. HTA worked with the YTI management last year to develop solutions to speed up the process, a successful endeavor to date given the January 2016 average was 76 minutes.

Eagle Marine Services and TraPac, both in Los Angeles, were tied for the slowest, averaging 105 minutes. Both terminals are in the middle of changes in their management and, in the case of Eagle Marine, new ownership as well.

“Eagle Marine has had some serious issues with their nighttime gate performance. Part of it may be the fact that they receive larger ships than other terminals with CMA CGM as their major customer. But there is an opportunity for us to work with them and implement some of the ideas that have worked with their neighbors,” LaBar said.

Total Terminals International, which averaged nearly two hours last summer, was back down to 86 minutes, the best result since February 2014. LaBar credits new CEO Graham Scott and his team for the turnaround.

Stevedores and truckers are typically busy in January in Los Angeles and Long Beach because manufacturing and shipping ramps up in Asia in the weeks before the Chinese Lunar New Year.

The Port of Los Angeles, No. 1 in annual container volumes, said container traffic fell 2.2% to 808,728 industry-standard 20-foot-equivalent units, or TEUs. However, the last two years are the only times in the port’s 107-year history in which the January total was greater than 800,000. In 2013, for example, the January total was 669,000 and did not cross 700,000 until 2016.

Imports increased 1.8% to 422,831 and but decreased 7.6% to 150,035 TEUs.

“After two consecutive years of record-breaking cargo, it’s encouraging to start 2018 with robust volumes,” Port of L.A. Executive Director Gene Seroka said. “It’s only the seventh time we have eclipsed the 800,000 TEU mark in a single month, and we’re grateful to our supply chain partners for their continued confidence in our world-class infrastructure, innovative technology solutions and extraordinary customer service.”

The Port of Long Beach, No. 2 in volumes, established a new January record with 657,830 TEUs, topping the 600,000 mark for the first time to begin a year since the 1911 opening. On a year-over-year basis, the total rose nearly 13%.

Loaded imports rose 8.6% to 324,656 and exports went up 1.9% to 120,503.

“The pre-Lunar New Year surge is definitely here,” said Long Beach Executive Director Mario Cordero, taking note of the two-week holiday period in Asia. “Since this year’s holiday began Feb. 16, we anticipated a busy January and February, as cargo owners seek to get goods shipped ahead of the festivities.”

“The Port of Long Beach is happy to have a great start to 2018, especially after the successes of last year,” Harbor Commission President Lou Anne Bynum added.

Last January, container traffic increased almost 9% year-over-year and in January 2016 volumes surged 25% over 2015.