Bloomberg News

US Jobless Claims Hit Four-Week High in Fresh Labor Setback

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

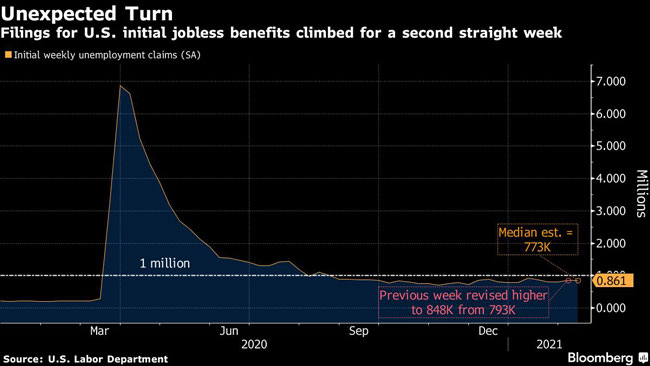

Applications for U.S. state unemployment insurance jumped to a four-week high, indicating the labor market is suffering fresh setbacks even as the coronavirus pandemic shows signs of ebbing.

Initial jobless claims in regular state programs totaled 861,000 in the week ended Feb. 13, up 13,000 from the prior week, Labor Department data showed Feb. 18. Last week’s report had originally shown a decrease but was revised up to show a 36,000 increase.

Continuing claims — an approximation of the number of people filing for ongoing state benefits — declined by 64,000 to 4.49 million in the week ended Feb. 6.

Continued weeks claimed for the federal pandemic program that extends the duration of unemployment benefits, known as Pandemic Emergency Unemployment Compensation, fell to 4.06 million in the week ended Jan. 30, a level that underscores the current breadth and duration of joblessness.

The latest data suggests the labor market has a tougher road to recovery than previously thought as initial claims have failed to show any sustained decline for five months. While other parts of the economy are near or above pre-pandemic levels, millions of Americans remain out of work and are struggling to pay their bills.

The data corresponds with the survey period for the monthly employment figures, and may set the tone for the Labor Department’s March 5 jobs report.

A separate report showed home construction declined in January for the first time in five months, though permits to build single-family houses rose at the fastest pace since 2006. The number of one-family dwellings authorized but not yet started increased to the highest in more than 13 years.

Manufacturing in the Federal Reserve Bank of Philadelphia region expanded in February at a faster than expected pace, while a measure of prices paid for materials rose to the highest level since 2018, another report Feb. 18 showed.

U.S. stock futures extended declines after the data, while 10-year Treasury yields remained higher.

Policymakers are watching employment data closely as they debate another round of stimulus. Democrats are on track to narrowly pass President Joe Biden’s $1.9 trillion package — even without the support of Republicans — which would extend federal unemployment programs again and increase the supplemental weekly jobless benefit to $400 from $300.

The number of unemployment claims should improve as more people are vaccinated and the economy continues to open up.

Want more news? Listen to today's daily briefing below or go here for more info: