North America’s largest trucking companies continued growth in 2022 despite a weaker freight environment

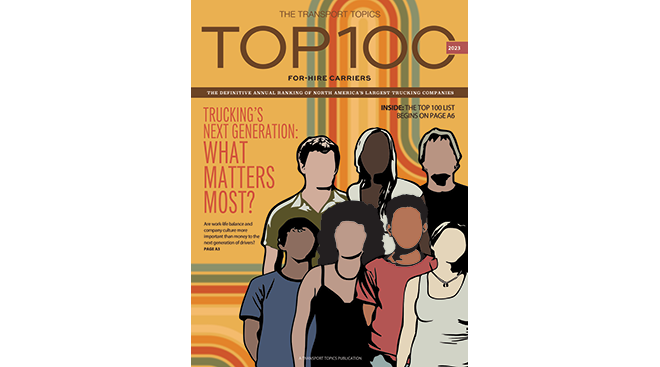

Recruiting the truckers of tomorrow is a top priority for trucking companies preparing for years to come

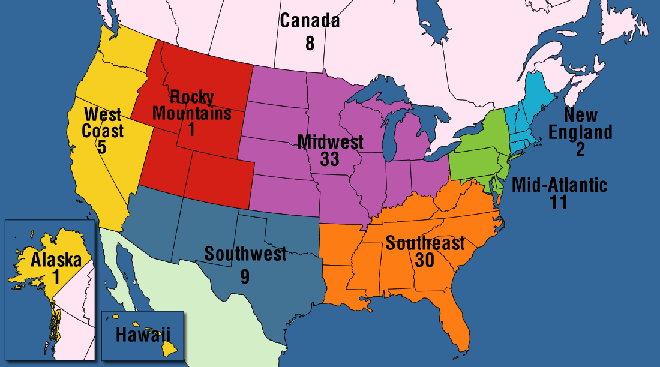

Find out where the Top 100 For-Hire carriers are located by region; click links to view details about the company

Top 100 For-Hire | Less-Than-Truckload | Truckload/Dedicated | Intermodal/Drayage | Motor Vehicle/Driveaway | Tank/Bulk

Air/Expedited | Refrigerated | Flatbed/Heavy Specialized | Package/Courier | Household Goods/Commercial | Mail

Top Household Goods/Commercial Delivery Carriers

| Rank | Company | Revenue (000) |

|---|---|---|

| 1 | UniGroup | 1,600,000 |

| 2 | Sirva | 1,400,000 est |

| 3 | Atlas World Group | 766,529 |

| 4 | Suddath | 600,000 est |

| 5 | Two Men and a Truck Movers | 524,900 est |

| 6 | CRST The Transportation Solution | 380,000 est |

| 7 | Day & Ross | 115,000 |

| 8 | Cardinal Logistics | 45,000 |

| 9 | Stevens Worldwide Van Lines | 34,600 est |

| 10 | Diligent Delivery Systems | 30,940 est |

| 11 | McCollister's Global Services | 5,200 |

Top For-Hire Carriers on this list are common and contract freight carriers operating in the United States, Canada and Mexico. Companies are ranked on the basis of annual revenue. To be included in the Top 100 or any of the sectors, please send contact information to tteditor@ttnews.com. We will contact you via phone or e-mail to get information about your company prior to publication of the next Top 100 list.

Sirva Worldwide Relocation & Moving and Suddath revenue is for 2018.

Two Men and a Truck Movers, Stevens Worldwide Van Lines and Diligent Delivery Systems revenue is for 2019.

CRST revenue is for 2021.

A top industry concern for years, suitable parking spaces remain elusive for many truckers

On the Bubble

The numerous, complex regulations faced by the trucking industry can be made simpler using new technology

If your company appears on the list, you have a few ways to announce it. Visit our logo library to get web- and print-ready graphics

While mergers and acquisitions alter the business landscape, top for-hire carriers grew revenues across segments in 2022

Learn more about how companies are selected for Transport Topics' Top 100 largest for-hire carriers list

Werner Enterprises Reports Earnings Drop on Steady Revenue

Werner Enterprises experienced a year-over-year drop in earnings on a slight decrease in revenue during the third quarter, the company reported Nov. 1.

Forward Air Reports 82% Earnings Drop During Q3

Forward Air Corp. reported an 82.2% drop in earnings during the third quarter of 2023 as revenue declined amid a weak freight environment, the company reported Oct 30.

Jack Cooper Making $2 Billion Bid for Bankrupt Yellow

Jack Cooper Transport is reportedly making a nearly $2 billion bid to snatch up the assets of Yellow, the trucking firm that collapsed in late July and filed for bankruptcy.

Court Approves Yellow Administrators’ Auction Plans

A court on Oct. 27 approved plans by the administrators of Yellow to use auctioneers to sell the company’s rolling stock, as Jack Cooper Transport eyes a bid to rescue the motor carrier.

XPO Reports Revenue Increase Despite Tough Conditions

XPO posted an increase in revenue but a dip in profit during the third quarter amid a challenging freight environment, the company said Oct 30.

Universal Reports Revenue Decline Amid Q3 Headwinds

Universal Logistics Holdings experienced an overall decrease in revenue, with each segment facing year-over-year declines for the third quarter of 2023, the company reported Oct 26.

Ryder Reports Slight Revenue Decline for Q3

Ryder System Inc. experienced a slight decline in year-over-year revenue amid market headwinds during the third quarter of 2023, the company reported Oct. 25.

Estes Express IT System Fully Restored, COO Says

Estes Express Lines’ information technology systems are “completely restored” after a cyberattack earlier in October, according to Chief Operating Officer Webb Estes.

UPS Reports Lower Earnings on Labor Deal Costs

UPS Inc. cut its annual profit target on a spike in costs from a new union labor contract and weaker package demand.

TFI Third-Quarter Profit Dives 45.6% on Weak Freight Market

TFI International profits in the third quarter slumped 45.6% year-over-year, with the Canadian company primarily citing weaker market conditions, especially in the truckload market.