Soft market conditions in 2023 placed financial strain on many of the largest trucking companies in North America.

Trucking companies have been surviving on lower rates while awaiting a freight market recovery.

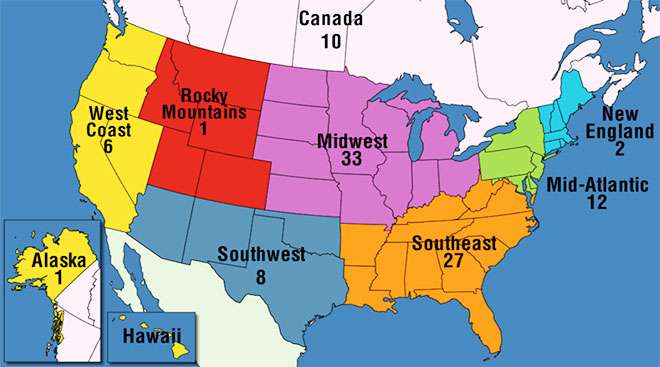

Find out where the Top 100 For-Hire carriers are located by region; click links to view details about the company.

Top 100 For-Hire | Less-Than-Truckload | Truckload/Dedicated | Intermodal/Drayage | Motor Vehicle/Driveaway | Tank/Bulk

Air/Expedited | Refrigerated | Flatbed/Heavy Specialized | Package/Courier | Household Goods/Commercial | Mail

Top Package/Courier Carriers

| Rank | Company | Revenue (000) |

|---|---|---|

| 1 | FedEx Corp. | 74,905,000 |

| 2 | UPS Inc. | 59,958,000 |

| 3 | Purolator | 2,653,000 |

| 4 | OnTrac Inc. | 1,525,716 est |

| 5 | TFI International | 461,930 |

| 6 | Spee-Dee Delivery Service | 182,415 |

| 7 | Fastfrate Group | 52,500 |

| 8 | Day & Ross | 7,645 |

Top For-Hire Carriers on this list are common and contract freight carriers operating in the United States, Canada and Mexico. Companies are ranked on the basis of annual revenue. To be included in the Top 100 or any of the sectors, please send contact information to tteditor@ttnews.com. We will contact you via phone or e-mail to get information about your company prior to publication of the next Top 100 list.

FedEx Corp. revenue is for the 12-month period ended Feb. 29, 2024.

OnTrac Inc. revenue is estimated by Transport Topics based on prior-year data and industry revenue trends.

The regional LTL carrier has adapted and expanded through a full century of economic cycles and industry changes.

The trucking industry remains mired in sustained overcapacity relative to freight demand even as it has slowly shed workers.

After being displaced by war in his native Sudan, Lual Akoon’s path took him to Middle America – and trucking.

If your company appears on the list, you have a few ways to announce it. Visit our logo library to get ready-made graphics.

For-hire carriers across segments saw revenues slide and margins tighten, but some fared better than others.

Learn more about how companies are selected for Transport Topics' Top 100 largest for-hire carriers list.

TFI Profit Falls 17.1% on ‘Worse Than Expected’ Market

Profits at TFI International fell 17.1% year-over-year in the first quarter of 2024 on the back of what CEO Alain Bédard said was a particularly weak freight environment.

Intermodal Chassis Manufacturers Pull Back on Output

Intermodal chassis manufacturers are scaling back production as a result of weak demand as well as a supply overhang, company executives said.

Top 100 For-Hire Carriers: How to Get on the List

Find out how your trucking business stacks up by submitting data for the 2024 Transport Topics Top 100 For-Hire Carriers publication.

April 25, 2024Knight-Swift Reports Earnings Drop Amid Revenue Growth

Knight-Swift Transportation Holdings saw its first-quarter bottom-line results swing from a profit to a loss.

Mullen Group Reports Lower Revenue for Q1

Mullen Group experienced a decrease in revenue and earnings during the first quarter of 2024, the company reported April 25.

Forward Air Hires Ex-Ceva Logistics Executive Stewart as CEO

Shawn Stewart is set to join Forward Air as CEO, effective April 28, the carrier said April 23. He also will join the asset-light transportation services group’s board of directors.

ODFL Reports Q1 Revenue and Earnings Growth

Old Dominion Freight Line experienced growth in revenue and earnings for the first quarter of 2024, the company reported April 24.

UPS Reports 41% Earnings Drop During Q1

UPS Inc. experienced a 41.3% drop in earnings during the first quarter of 2024, the company reported April 23.

Five Auto Haulers to Merge as Backer Files for IPO

Five auto carriers look set to merge, with the combined entity likely to then add to its assets by buying up competitors, if an initial public offering pans out as planned.

J.B. Hunt Reports $2.9 Billion Revenue for Q1

J.B. Hunt Transport Services Inc. experienced a decline in revenue and earnings during the first quarter of 2024, the company reported April 16.