Soft market conditions in 2023 placed financial strain on many of the largest trucking companies in North America.

Trucking companies have been surviving on lower rates while awaiting a freight market recovery.

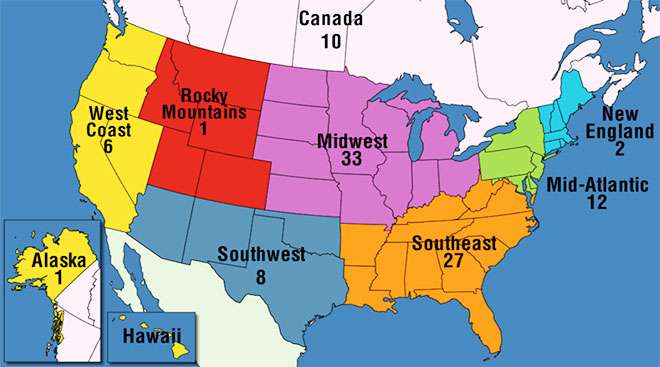

Find out where the Top 100 For-Hire carriers are located by region; click links to view details about the company.

Top 100 For-Hire | Less-Than-Truckload | Truckload/Dedicated | Intermodal/Drayage | Motor Vehicle/Driveaway | Tank/Bulk

Air/Expedited | Refrigerated | Flatbed/Heavy Specialized | Package/Courier | Household Goods/Commercial | Mail

Top Truckload/Dedicated Carriers

| Rank | Company | Revenue (000) |

|---|---|---|

| 1 | Knight-Swift Transportation | 4,698,655 |

| 2 | J.B. Hunt Transport Services | 4,332,439 |

| 3 | Landstar System | 2,742,281 |

| 4 | Werner Enterprises | 2,310,810 |

| 5 | Ryder Dedicated Transportation Solutions | 2,211,000 |

| 6 | Penske Logistics | 2,200,000 |

| 7 | Schneider | 2,156,000 |

| 8 | TFI International | 1,625,592 |

| 9 | CRST The Transportation Solution | 1,350,000 est |

| 10 | Crete Carrier Corp. | 1,342,000 |

| 11 | Heartland Express | 1,207,000 |

| 12 | Ruan | 912,000 est |

| 13 | NFI | 823,401 |

| 14 | Western Express | 743,578 est |

| 15 | C.R. England | 709,335 est |

| 16 | FirstFleet | 609,000 est |

| 17 | Universal Truckload | 557,417 |

| 18 | Day & Ross Freight | 535,150 |

| 19 | Bison Transport | 480,246 |

| 20 | P.A.M. Transport | 460,900 |

| 21 | Mesilla Valley Transportation | 446,000 est |

| 22 | Cowan Systems | 429,381 |

| 23 | Marten Transport | 408,272 |

| 24 | USA Truck | 367,650 est |

| 25 | Fastfrate Group | 344,000 |

| 26 | Covenant Logistics Group | 320,287 |

| 27 | New Legend | 311,928 est |

| 28 | Artur Express | 298,248 est |

| 29 | Roehl Transport | 285,205 est |

| 30 | Evans Delivery | 237,000 |

| 31 | Canada Cartage | 232,811 est |

| 32 | Paper Transport | 213,287 |

| 33 | Anderson Trucking Service | 209,700 |

| 34 | PS Logistics | 182,600 est |

| 35 | TCI Transportation | 173,000 |

| 36 | Forward Air | 159,513 |

| 37 | Averitt Express | 158,360 est |

| 38 | Cheema Freightlines | 148,452 |

| 39 | GP Transco | 148,262 est |

| 40 | Transportation Services | 141,000 |

| 41 | System Freight | 137,212 |

| 42 | A. Duie Pyle | 136,000 |

| 43 | Titan Transfer | 125,244 est |

| 44 | Cargo Transporters | 121,436 |

| 45 | Transervice Logistics | 118,162 est |

| 46 | Leonard's Express | 116,414 est |

| 47 | Southeastern Freight Lines | 89,207 |

| 48 | Highlight Motor Group | 83,230 est |

| 49 | May Trucking Co. | 71,644 |

| 50 | RoadOne IntermodaLogistics | 50,000 |

| 51 | TGR Logistics | 47,000 |

| 52 | Schuster Co. | 44,600 |

| 53 | AMX Trucking | 38,040 est |

| 54 | Paul Logistics | 33,000 |

| 55 | Aifleet | 30,099 |

| 56 | McCollister's Global Services | 28,530 est |

| 57 | Dupré Logistics | 27,522 |

| 58 | Beemac Trucking | 19,020 est |

| 59 | Atlas World Group | 18,024 |

| 60 | Trans-System | 14,000 |

Top For-Hire Carriers on this list are common and contract freight carriers operating in the United States, Canada and Mexico. Companies are ranked on the basis of annual revenue. To be included in the Top 100 or any of the sectors, please send contact information to tteditor@ttnews.com. We will contact you via phone or e-mail to get information about your company prior to publication of the next Top 100 list.

Ryder’s revenue is adjusted to reflect its acquisition of Cardinal Logistics in February 2024.

CRST, Western Express, C.R. England, USA Truck, New Legend, Artur Express, Roehl Transport, Canada Cartage, PS Logistics, Averitt Express, GP Transco, Titan Transfer, Transervice Logistics, Leonard’s Express,

AMX Trucking, McCollister’s and Beemac Trucking revenues are estimated by Transport Topics based on prior-year data and industry revenue trends.

Crete Carrier Corp. and Heartland Express revenues are via SJ Consulting Group.

Ruan, FirstFleet and Mesilla Valley Transportation revenues are estimated by SJ Consulting Group.

The regional LTL carrier has adapted and expanded through a full century of economic cycles and industry changes.

The trucking industry remains mired in sustained overcapacity relative to freight demand even as it has slowly shed workers.

After being displaced by war in his native Sudan, Lual Akoon’s path took him to Middle America – and trucking.

If your company appears on the list, you have a few ways to announce it. Visit our logo library to get ready-made graphics.

For-hire carriers across segments saw revenues slide and margins tighten, but some fared better than others.

Learn more about how companies are selected for Transport Topics' Top 100 largest for-hire carriers list.

Forward Air Posts Q2 Loss, but Revenue Soars on Acquisition

Despite the reported net loss, investors appeared to be responding positively. It was primarily due to a one-time goodwill impairment charge related to the Omni acquisition.

ArcBest Q2 Profit Climbs on LTL Margin, Price Increase

Profit at ArcBest rose 16.1% year over year in the second quarter as an improvement in less-than-truckload revenue per shipment and an increase in prices trumped a decline in shipments.

Hub Group Misses Analyst Expectations on Weak Q2 Market

Hub Group profit in the second quarter of 2024 fell due to the ongoing weakness in the North American freight market, but a final-mile acquisition in December 2023 offered a bright spot.

Schneider Q2 Profit Slumps as Intermodal, Logistics Revenue Falls

Schneider National profit in the second quarter of 2024 slumped 54% as price increases failed to arrive as early as the carrier expected and ongoing freight market weakness saw intermodal and logistics revenue decline.

XPO Q2 Profit Jumps as LTL Shipments Rise 4.5%

XPO profit jumped in the second quarter as revenue increased 8% on the back of a 4.5% increase in North American LTL shipments and 7.4% rise in the return obtained for those shipments.

Landstar Q2 Profits Dip Amid Dry Van Market Softness

Profit and revenue at Landstar System Inc. fell in the second quarter of 2024, largely on the back of truckload market weakness.

Werner Spots Signs of Hope Despite Disappointing Q2

Profit dropped at Werner Enterprises Inc. in the second quarter of 2024 as revenue slid more than analysts expected on the back of continued freight weakness, although executives are seeing more room for optimism from the last few weeks.

Estes Eyes 12% Terminal Door Total Increase in 2024

Estes Express Lines expects the number of terminal doors in the less-than-truckload carrier’s portfolio to jump more than 12% in 2024 to a total exceeding 12,750.

Saia Lifts Target for 2024 Terminal Openings to 21

Saia could open a large batch of terminals in 2024 as profits and revenue grow at the less-than-truckload carrier, largely on the back of facilities acquired from the estate of Yellow Corp.

TFI Eyes Large Truckload, LTL Acquisitions in 2025, 2026

TFI International’s ongoing acquisition spree is set to accelerate in 2025, with substantial truckload and less-than-truckload deals on the horizon, according to CEO Alain Bédard.