Truck Tonnage Dips, but Freight Outlook Remains Strong

A year-long surge in freight volume continues despite a modest dip in a widely followed truck tonnage index over the past two months.

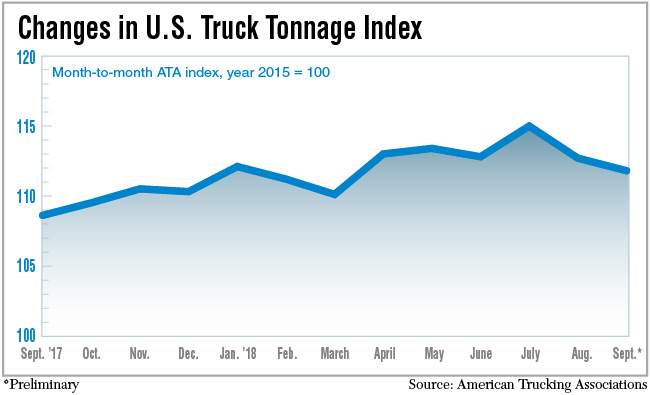

The American Trucking Associations’ For-Hire Truck Tonnage Index fell 0.8% to 111.8 in September from a revised 112.7 in August, but still is 2.9% above where it was in September 2017 and is 7% higher for the year to date compared to 2017. The index reached a peak at 115 in July.

“There is no doubt that freight softened in August and September,” ATA Chief Economist Bob Costello said, noting that overall economic growth may have slowed a bit after an especially strong expansion of U.S. Gross Domestic Product in the second quarter.

“The economy remains on solid footing,” Costello told Transport Topics. “GDP growth did ease from the second to the third quarters, which is when tonnage slowed.”

Another factor could be the impact of recent storms that hit parts of the U.S. Gulf Coast and Southeast last month.

“That likely had at least a small negative impact on September tonnage,” Costello said, adding that he still expects to see “solid” 3.6% growth in GDP for the third quarter compared with a “robust” 4.2% figure in the second quarter.

ATA calculates the tonnage index based on surveys of its membership and has been doing so since the 1970s.

“We are now up against some very tough year-over-year comps,” Costello said in explaining why we should expect to see shrinking percentage changes in the tonnage index in the months ahead.

Costello

“What’s more important going forward is the level of tonnage, not the year-over-year gains, as the fourth quarter in 2017 was very strong,” he said. “I’m expecting a solid holiday spending season by consumers, which should translate into good freight volumes for the industry.”

Judging from comments from executives during earnings calls by publicly-traded trucking companies last week, there is concurrence in the outlook for strong freight volumes to continue.

Jim Gattoni, CEO of Landstar System, said he expects a seasonal surge in holiday shipping similar what the industry experienced a year ago, and is optimistic as the year winds down.

“2018 is a remarkable year,” Gattoni told investment analysts in a conference call on Oct. 25, “and we will finish on a strong note.”

Waggoner

Landstar will mark its 30th year in business at the end of the year, and Gattoni said it’s possible that the company could generate total revenue of more than $4.5 billion, a jump of nearly $1 billion from the year before.

Doug Waggoner, CEO of Echo Global Logistics, said he also sees a strong peak shipping season ahead. “Shippers are bullish,” he said in a conference call with investment analysts on Oct. 24. “Economic indicators are strong and we don’t see large carriers adding capacity.”

ATA’s Costello confirmed that for-hire truckload carriers, which represent the lion’s share of freight hauling capacity, are not able to expand their fleets due to ongoing problems in getting drivers.

“At this point,” Costello said, “capacity is pretty flat on a year-over-year basis.”

Broughton

Another indicator pointing to strength in the market for freight hauling is the Cass Freight Index, which measures changes in shipments and expenditures from a sampling of freight bills.

Donald Broughton, an independent investment analyst and author of the Cass report, said the index of shipments “is clearly signaling that the U.S. economy, at least for now, continues to be extraordinarily strong” with little chance of economic downturn in the offing.

“We are hard-pressed to imagine a scenario, barring a catastrophic geopolitical event, in which such a strong rate of freight expansion was possible or even a precursor to an economic contraction,” Broughton said.

He said data on expenditures show that freight carriers will continue to have pricing power in a capacity-constrained market.

“Demand is exceeding capacity in most modes of transportation by a significant margin,” he wrote in a report published Oct. 18.

ATA’s Costello, in a commentary for a report on freight payments published by U.S. Bank, bolstered that viewpoint.

“There are only two factors moving forward that will alter the tight capacity situation,” he wrote. “Either the industry attracts a significant number of new truck drivers in a short period of time, which is highly unlikely, or volumes have a prolonged reduction. It will be the latter that ultimately breaks this cycle, but at this point, that looks more like a 2020 event.”