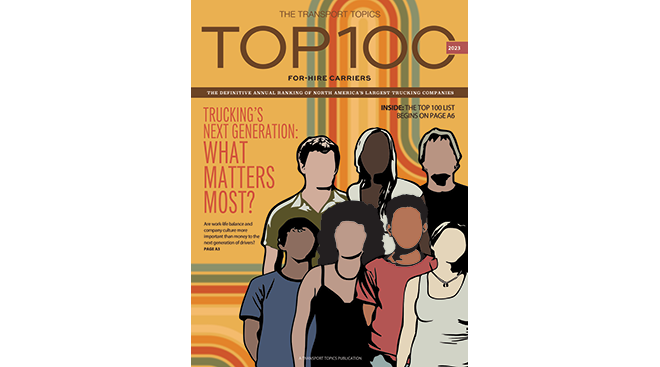

North America’s largest trucking companies continued growth in 2022 despite a weaker freight environment

Recruiting the truckers of tomorrow is a top priority for trucking companies preparing for years to come

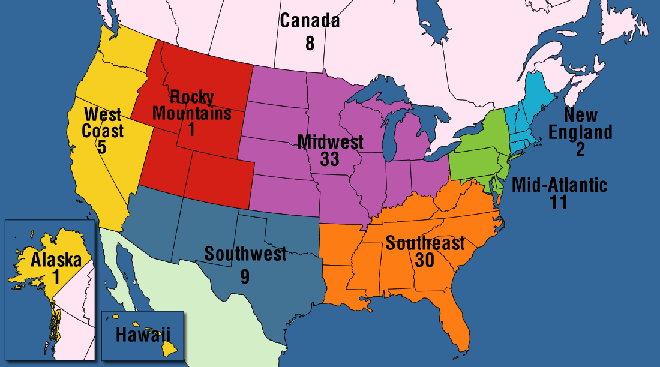

Find out where the Top 100 For-Hire carriers are located by region; click links to view details about the company

Top 100 For-Hire | Less-Than-Truckload | Truckload/Dedicated | Intermodal/Drayage | Motor Vehicle/Driveaway | Tank/Bulk

Air/Expedited | Refrigerated | Flatbed/Heavy Specialized | Package/Courier | Household Goods/Commercial | Mail

Top Household Goods/Commercial Delivery Carriers

| Rank | Company | Revenue (000) |

|---|---|---|

| 1 | UniGroup | 1,600,000 |

| 2 | Sirva | 1,400,000 est |

| 3 | Atlas World Group | 766,529 |

| 4 | Suddath | 600,000 est |

| 5 | Two Men and a Truck Movers | 524,900 est |

| 6 | CRST The Transportation Solution | 380,000 est |

| 7 | Day & Ross | 115,000 |

| 8 | Cardinal Logistics | 45,000 |

| 9 | Stevens Worldwide Van Lines | 34,600 est |

| 10 | Diligent Delivery Systems | 30,940 est |

| 11 | McCollister's Global Services | 5,200 |

Top For-Hire Carriers on this list are common and contract freight carriers operating in the United States, Canada and Mexico. Companies are ranked on the basis of annual revenue. To be included in the Top 100 or any of the sectors, please send contact information to tteditor@ttnews.com. We will contact you via phone or e-mail to get information about your company prior to publication of the next Top 100 list.

Sirva Worldwide Relocation & Moving and Suddath revenue is for 2018.

Two Men and a Truck Movers, Stevens Worldwide Van Lines and Diligent Delivery Systems revenue is for 2019.

CRST revenue is for 2021.

A top industry concern for years, suitable parking spaces remain elusive for many truckers

On the Bubble

The numerous, complex regulations faced by the trucking industry can be made simpler using new technology

If your company appears on the list, you have a few ways to announce it. Visit our logo library to get web- and print-ready graphics

While mergers and acquisitions alter the business landscape, top for-hire carriers grew revenues across segments in 2022

Learn more about how companies are selected for Transport Topics' Top 100 largest for-hire carriers list

Covenant's Q3 Net Income and Revenue Take Slight Dips

The company reported third-quarter net income of $13 million, or 94 cents per share, compared with $13.5 million, 99 cents, in the year-ago period.

October 29, 2024Saia Reports Q3 Revenue Growth Amid Network Expansion

Saia Inc. reported Oct. 25 that it was able to post record-high third-quarter revenue amid an ongoing effort to expand its operational footprint.

Anchorage’s International Airport Adds 5 Carriers

The Ted Stevens Anchorage International Airport has added five new international cargo carriers to its lineup this year, setting the stage for continued growth.

Ryder Q3 Profit Slides Even as Acquisitions Boost Revenue

Looking forward, Chief Financial Officer John Diez said Ryder expects earnings growth in the fourth quarter as a result of its contractual portfolio.

Mullen Group Q3 Earnings Dip Despite Revenue Growth

The Okotoks, Alberta-based company posted net income of C$38.3 million, or 41 cents a diluted share, for the three months ending Sept. 30.

Knight-Swift Reports Nearly $1.9B in Revenue for Q3

Knight-Swift Transportation Holdings experienced a 49.4% decline in earnings year over year during the third quarter of 2024, the company reported Oct. 23.

UPS Sees Profit Growth for First Time in Nearly Two Years

UPS Inc. posted a year-over-year increase in revenue during the third quarter of 2024 despite challenging market conditions, the company reported Oct. 24.

Lynden Transport Selected to Deliver Capitol Christmas Tree

Lynden Transport will carry the Capitol Christmas Tree from Alaska to the nation’s capital later this year.

Walmart Challenges Amazon With Prescription Delivery

Walmart Inc. will start delivering prescriptions to U.S. homes in as little as 30 minutes, a move that’s intended to grab a bigger slice of online spending and compete against Amazon.com Inc.

Consumers Switch to Slower Shipping, Squeezing UPS, FedEx

More people are switching to slower delivery options to save money, and profits at FedEx Corp. and UPS Inc. are getting squeezed.