North America’s largest trucking companies continued growth in 2022 despite a weaker freight environment

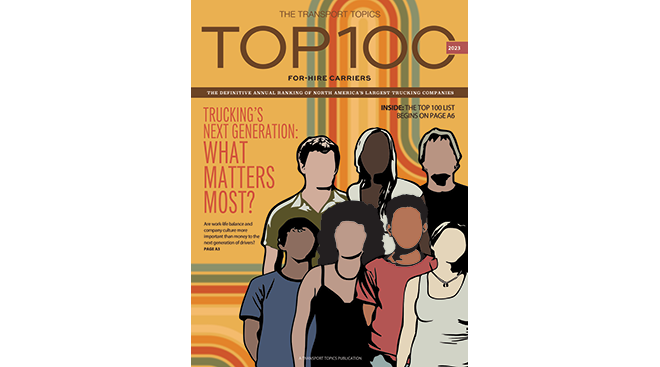

Recruiting the truckers of tomorrow is a top priority for trucking companies preparing for years to come

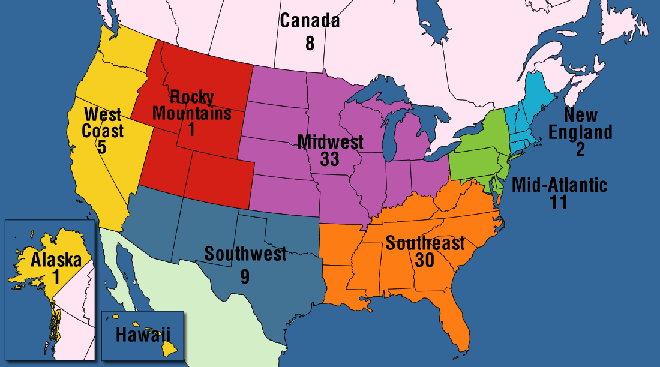

Find out where the Top 100 For-Hire carriers are located by region; click links to view details about the company

Top 100 For-Hire | Less-Than-Truckload | Truckload/Dedicated | Intermodal/Drayage | Motor Vehicle/Driveaway | Tank/Bulk

Air/Expedited | Refrigerated | Flatbed/Heavy Specialized | Package/Courier | Household Goods/Commercial | Mail

Top Household Goods/Commercial Delivery Carriers

| Rank | Company | Revenue (000) |

|---|---|---|

| 1 | UniGroup | 1,600,000 |

| 2 | Sirva | 1,400,000 est |

| 3 | Atlas World Group | 766,529 |

| 4 | Suddath | 600,000 est |

| 5 | Two Men and a Truck Movers | 524,900 est |

| 6 | CRST The Transportation Solution | 380,000 est |

| 7 | Day & Ross | 115,000 |

| 8 | Cardinal Logistics | 45,000 |

| 9 | Stevens Worldwide Van Lines | 34,600 est |

| 10 | Diligent Delivery Systems | 30,940 est |

| 11 | McCollister's Global Services | 5,200 |

Top For-Hire Carriers on this list are common and contract freight carriers operating in the United States, Canada and Mexico. Companies are ranked on the basis of annual revenue. To be included in the Top 100 or any of the sectors, please send contact information to tteditor@ttnews.com. We will contact you via phone or e-mail to get information about your company prior to publication of the next Top 100 list.

Sirva Worldwide Relocation & Moving and Suddath revenue is for 2018.

Two Men and a Truck Movers, Stevens Worldwide Van Lines and Diligent Delivery Systems revenue is for 2019.

CRST revenue is for 2021.

A top industry concern for years, suitable parking spaces remain elusive for many truckers

On the Bubble

The numerous, complex regulations faced by the trucking industry can be made simpler using new technology

If your company appears on the list, you have a few ways to announce it. Visit our logo library to get web- and print-ready graphics

While mergers and acquisitions alter the business landscape, top for-hire carriers grew revenues across segments in 2022

Learn more about how companies are selected for Transport Topics' Top 100 largest for-hire carriers list

Hub Group Misses Analyst Expectations on Weak Q2 Market

Hub Group profit in the second quarter of 2024 fell due to the ongoing weakness in the North American freight market, but a final-mile acquisition in December 2023 offered a bright spot.

Schneider Q2 Profit Slumps as Intermodal, Logistics Revenue Falls

Schneider National profit in the second quarter of 2024 slumped 54% as price increases failed to arrive as early as the carrier expected and ongoing freight market weakness saw intermodal and logistics revenue decline.

XPO Q2 Profit Jumps as LTL Shipments Rise 4.5%

XPO profit jumped in the second quarter as revenue increased 8% on the back of a 4.5% increase in North American LTL shipments and 7.4% rise in the return obtained for those shipments.

Landstar Q2 Profits Dip Amid Dry Van Market Softness

Profit and revenue at Landstar System Inc. fell in the second quarter of 2024, largely on the back of truckload market weakness.

Werner Spots Signs of Hope Despite Disappointing Q2

Profit dropped at Werner Enterprises Inc. in the second quarter of 2024 as revenue slid more than analysts expected on the back of continued freight weakness, although executives are seeing more room for optimism from the last few weeks.

Estes Eyes 12% Terminal Door Total Increase in 2024

Estes Express Lines expects the number of terminal doors in the less-than-truckload carrier’s portfolio to jump more than 12% in 2024 to a total exceeding 12,750.

Saia Lifts Target for 2024 Terminal Openings to 21

Saia could open a large batch of terminals in 2024 as profits and revenue grow at the less-than-truckload carrier, largely on the back of facilities acquired from the estate of Yellow Corp.

TFI Eyes Large Truckload, LTL Acquisitions in 2025, 2026

TFI International’s ongoing acquisition spree is set to accelerate in 2025, with substantial truckload and less-than-truckload deals on the horizon, according to CEO Alain Bédard.

FAA Clears Drone Companies to Operate in Shared Airspace

The FAA has cleared Wing and Zipline to fly their drones simultaneously over the suburbs of Dallas-Fort Worth without visual observers, using technology to keep the drones apart.

Saia Q2 Profit, Revenue Rise on Former Yellow Facilities

Profits and revenues at Saia Inc. jumped in the second quarter of 2024 as the carrier continued to benefit from the collapse of erstwhile less-than-truckload rival Yellow Corp.