North America’s largest trucking companies continued growth in 2022 despite a weaker freight environment

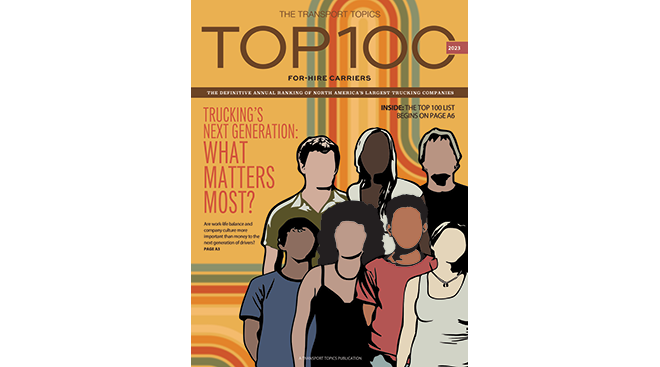

Recruiting the truckers of tomorrow is a top priority for trucking companies preparing for years to come

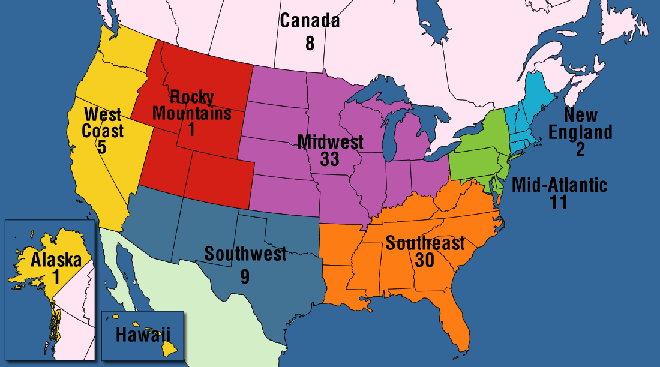

Find out where the Top 100 For-Hire carriers are located by region; click links to view details about the company

Top 100 For-Hire | Less-Than-Truckload | Truckload/Dedicated | Intermodal/Drayage | Motor Vehicle/Driveaway | Tank/Bulk

Air/Expedited | Refrigerated | Flatbed/Heavy Specialized | Package/Courier | Household Goods/Commercial | Mail

Top Household Goods/Commercial Delivery Carriers

| Rank | Company | Revenue (000) |

|---|---|---|

| 1 | UniGroup | 1,600,000 |

| 2 | Sirva | 1,400,000 est |

| 3 | Atlas World Group | 766,529 |

| 4 | Suddath | 600,000 est |

| 5 | Two Men and a Truck Movers | 524,900 est |

| 6 | CRST The Transportation Solution | 380,000 est |

| 7 | Day & Ross | 115,000 |

| 8 | Cardinal Logistics | 45,000 |

| 9 | Stevens Worldwide Van Lines | 34,600 est |

| 10 | Diligent Delivery Systems | 30,940 est |

| 11 | McCollister's Global Services | 5,200 |

Top For-Hire Carriers on this list are common and contract freight carriers operating in the United States, Canada and Mexico. Companies are ranked on the basis of annual revenue. To be included in the Top 100 or any of the sectors, please send contact information to tteditor@ttnews.com. We will contact you via phone or e-mail to get information about your company prior to publication of the next Top 100 list.

Sirva Worldwide Relocation & Moving and Suddath revenue is for 2018.

Two Men and a Truck Movers, Stevens Worldwide Van Lines and Diligent Delivery Systems revenue is for 2019.

CRST revenue is for 2021.

A top industry concern for years, suitable parking spaces remain elusive for many truckers

On the Bubble

The numerous, complex regulations faced by the trucking industry can be made simpler using new technology

If your company appears on the list, you have a few ways to announce it. Visit our logo library to get web- and print-ready graphics

While mergers and acquisitions alter the business landscape, top for-hire carriers grew revenues across segments in 2022

Learn more about how companies are selected for Transport Topics' Top 100 largest for-hire carriers list

Estes Purchases Seven Former Yellow Terminals

Estes has closed on lease purchases for seven terminals across the country that used to belong to the defunct carrier Yellow Corp., the company announced Aug. 22.

Kenan Advantage Group Acquires Chemical Transporter TransVac

Kenan Advantage Group on Aug. 20 announced that it acquired specialty transportation provider TransVac.

Mike Gannon Appointed to Lead CRST

CRST has appointed Mike Gannon as its newest president and CEO, the company announced Aug. 23.

August 23, 2024XPO Explores Sale of European Transportation Business

XPO has revived a sale of its European transportation business, according to people familiar with the matter, almost two years since it last scrapped the attempt to divest the operation.

Trucking Insurance Concerns Go Beyond High Premiums

Although high premiums have been a top concern, industry leaders and state regulators have taken action to curb other insurance challenges that greatly affect the industry at large.

August 9, 2024Forward Air Posts Q2 Loss, but Revenue Soars on Acquisition

Despite the reported net loss, investors appeared to be responding positively. It was primarily due to a one-time goodwill impairment charge related to the Omni acquisition.

ArcBest Q2 Profit Climbs on LTL Margin, Price Increase

Profit at ArcBest rose 16.1% year over year in the second quarter as an improvement in less-than-truckload revenue per shipment and an increase in prices trumped a decline in shipments.

Hub Group Misses Analyst Expectations on Weak Q2 Market

Hub Group profit in the second quarter of 2024 fell due to the ongoing weakness in the North American freight market, but a final-mile acquisition in December 2023 offered a bright spot.

Schneider Q2 Profit Slumps as Intermodal, Logistics Revenue Falls

Schneider National profit in the second quarter of 2024 slumped 54% as price increases failed to arrive as early as the carrier expected and ongoing freight market weakness saw intermodal and logistics revenue decline.

XPO Q2 Profit Jumps as LTL Shipments Rise 4.5%

XPO profit jumped in the second quarter as revenue increased 8% on the back of a 4.5% increase in North American LTL shipments and 7.4% rise in the return obtained for those shipments.