North America’s largest trucking companies continued growth in 2022 despite a weaker freight environment

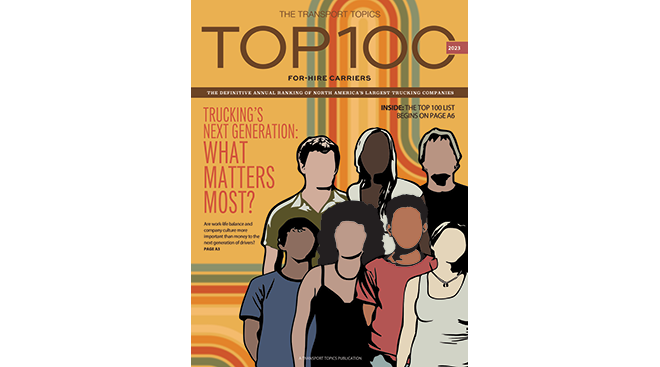

Recruiting the truckers of tomorrow is a top priority for trucking companies preparing for years to come

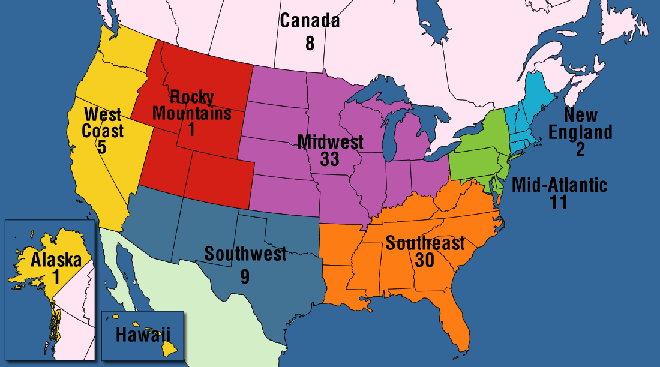

Find out where the Top 100 For-Hire carriers are located by region; click links to view details about the company

Top 100 For-Hire | Less-Than-Truckload | Truckload/Dedicated | Intermodal/Drayage | Motor Vehicle/Driveaway | Tank/Bulk

Air/Expedited | Refrigerated | Flatbed/Heavy Specialized | Package/Courier | Household Goods/Commercial | Mail

Top Household Goods/Commercial Delivery Carriers

| Rank | Company | Revenue (000) |

|---|---|---|

| 1 | UniGroup | 1,600,000 |

| 2 | Sirva | 1,400,000 est |

| 3 | Atlas World Group | 766,529 |

| 4 | Suddath | 600,000 est |

| 5 | Two Men and a Truck Movers | 524,900 est |

| 6 | CRST The Transportation Solution | 380,000 est |

| 7 | Day & Ross | 115,000 |

| 8 | Cardinal Logistics | 45,000 |

| 9 | Stevens Worldwide Van Lines | 34,600 est |

| 10 | Diligent Delivery Systems | 30,940 est |

| 11 | McCollister's Global Services | 5,200 |

Top For-Hire Carriers on this list are common and contract freight carriers operating in the United States, Canada and Mexico. Companies are ranked on the basis of annual revenue. To be included in the Top 100 or any of the sectors, please send contact information to tteditor@ttnews.com. We will contact you via phone or e-mail to get information about your company prior to publication of the next Top 100 list.

Sirva Worldwide Relocation & Moving and Suddath revenue is for 2018.

Two Men and a Truck Movers, Stevens Worldwide Van Lines and Diligent Delivery Systems revenue is for 2019.

CRST revenue is for 2021.

A top industry concern for years, suitable parking spaces remain elusive for many truckers

On the Bubble

The numerous, complex regulations faced by the trucking industry can be made simpler using new technology

If your company appears on the list, you have a few ways to announce it. Visit our logo library to get web- and print-ready graphics

While mergers and acquisitions alter the business landscape, top for-hire carriers grew revenues across segments in 2022

Learn more about how companies are selected for Transport Topics' Top 100 largest for-hire carriers list

Pup Trailers Can Help Fleets Improve Efficiency, Lower Costs

Trucks pulling two 28-foot trailers, or “pups,” have become common in the LTL segment as large fleets utilize these vehicle combinations to increase flexibility in their delivery networks.

Nikola Leads Field in Hydrogen Fuel Cell EV Deployment

Hydrogen fuel cell electric vehicles may be envisioned as the future workhorse of a decarbonized longhaul freight sector, but their development has proceeded at a measured pace.

Intermodal Load Growth Cushions Hub Group Q3 Profit Decline

Hub Group profit and revenue fell in Q3 2024, but intermodal load growth mitigated the damage and the carrier’s top executive is becoming more optimistic about the freight environment.

Schneider Q3 Revenue, Profit Decline in Weak Freight Market

The company's results missed expectations from investment analysts on Wall Street, who had been looking for earnings per share of 23 cents and quarterly revenue of $1.33 billion.

Heartland Express in Red for Q3 Again but Loss Narrows

Losses at Heartland Express narrowed year over year in the third quarter as both legacy brands and two more recently acquired units turned in an improved performance.

Ongoing Truckload Weakness, Helene Hurt P.A.M. Q3 Profit

Profits at P.A.M. Transport slumped 61% in the third quarter of 2024 on the back of continued truckload market weakness and the impact of Hurricane Helene.

Forward Air Revenue Soars 92%; Net Loss Hits $34M

The Tennessee-based ground transportation and logistics services provider posted a net loss of $34.2 million, or negative $2.62 a diluted share, for the three months ending Sept. 30.

Retailers Offer ‘Returnless Refunds’ to Reduce Shipping Fees

Returnless refunds are a tool that more retailers are using to keep online shoppers happy and to reduce shipping fees, processing time and other ballooning costs from returned products.

Werner Revenue and Profit Decline on Q3 Market Struggles

The Omaha, Neb.-based carrier’s Q3 net income fell 72% to $6.6 million, or 11 cents per share, compared with $23.7 million, 37 cents, a year ago.

October 30, 2024XPO Net Income Climbs 10% on Strong LTL Pricing in Q3

XPO’s North American LTL segment, its core operation, increased revenue by 1.9% to $1.25 billion from $1.23 billion last year despite declines in shipment volumes.

October 30, 2024